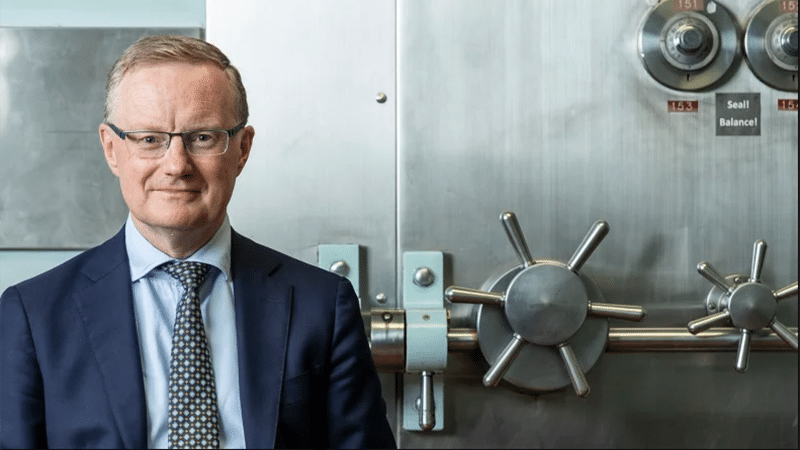

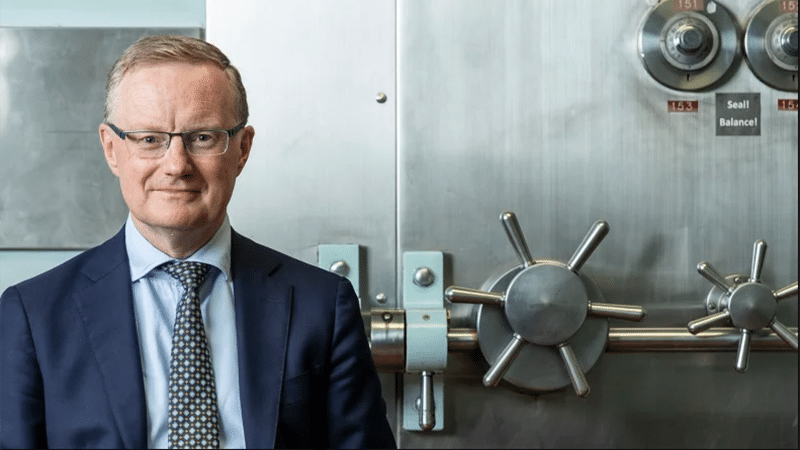

Inflation finally forces the RBA’s hand

[ad_1] A headline inflation rate above 5 per cent was the catalyst for the Reserve Bank of Australia to finally lift interest rates for the

[ad_1] A headline inflation rate above 5 per cent was the catalyst for the Reserve Bank of Australia to finally lift interest rates for the

[ad_1] Concerns the Reserve Bank of Australia (RBA) will significantly raise interest rates this week has triggered fear in Australian home owners and investors who

[ad_1] For anyone considering a move from their industry fund into their own personally tailored self-managed superannuation fund, there are a lot of cons to

[ad_1] Borrowers are shunning fixed rate loans as banks hike rates on a weekly basis.NAB has on Friday (22 April) made its fourth round of

[ad_1] The Reserve Bank of Australia has given its strongest indication yet that the first official interest rate rise in 12 years is around the

[ad_1] With property issues again shaping as one of the key election issues for many Australians, API Magazine takes a look at the property and

[ad_1] The misleading practice of underquoting is illegal but loopholes exist that are allowing sellers to dupe buyers into overcommitting on bids they can’t afford.

[ad_1] Homeowners and property investors were spared an interest rate rise by the Reserve Bank of Australia, which has again used the first Tuesday of

[ad_1] Reaction from property sector leaders to the 2022-23 Federal budget has ranged from effusive praise to harsh criticism and API Magazine spoke to ten

[ad_1] dummy text ….Faced with rising living costs and looming interest rate increases, a concerning number of mortgage borrowers are on the brink of financial