[ad_1]

I started ProSolution almost 20 years ago and if there’s been one common theme over that time, it is how “expensive” property is.

The reality is that property has always seemed relatively expensive.

And it’s probably never going to change.

You must get used to it and learn to make prudent decisions despite the prevailing property price rhetoric.

I felt ill after almost every property I’ve bought

In December 2006, I engaged a buyer’s agent to select and purchase an investment-grade property.

He ended up buying a single-fronted Victorian cottage on a small block (146 sqm) in Prahran, Melbourne for $723,000.

It was a record price for that street (the street is lined with similar Victorian cottages) and probably suburbs.

Paying a record price didn’t feel satisfying.

In fact, it gave me indigestion.

But I trusted that buying an investment-grade asset that possessed sound fundamentals will work out well in the long run.

This property last sold in August 2019 for $1.362 million (unfortunately, I had to dispose of it as part of my marriage separation in 2012).

That makes the price in 2006 seem relatively cheap today.

Government policy supports property prices, and probably always will

The government’s policies have always supported property values.

And I think there’s a strong case to argue that the government shouldn’t interfere with the property market.

But the reality is, they always have, and probably always will.

There are several examples of this including taxation incentives like negative gearing, the Rudd government doubling of the First Home Owners Boost in 2008 in the middle of the GFC, the federal government asking the banks to provide loan repayment pauses last year, and so forth.

As soon as the property market has some challenges, the government always steps in.

There are two realities to acknowledge.

They impair consumer confidence and therefore consumer spending, and that deteriorates the whole economy.

Secondly, the big four banks have a vested interest in a healthy property market, and it is not difficult to imagine that they have substantial lobbying power in Canberra.

Again, I’m not suggesting that these vested interests are healthy, just merely pointing out that they exist, and history is evidence of that.

Their existence means that the government is likely to intervene to avoid a property price crash.

Could property prices ever crash?

For property prices to crash, there needs to be widespread selling i.e. more sellers than buyers.

Practically, this can only happen if the property market is in oversupply i.e. there are more houses than people to occupy them.

This is what happened in the US in 2008.

In some locations in the US, the housing market was over-supply (i.e. there were empty houses) which led to large price falls.

Therefore, if the Australian market remains in a supply/demand equilibrium, a property market crash remains very unlikely, because we all need somewhere to live.

The chart below illustrates the median house price in Sydney, Melbourne, and Brisbane since 1980.

It shows that negative returns should be expected every 5 years in Sydney, approximately every 7 years in Melbourne, and less than every 10 years in Brisbane.

It should be noted that this data represents that change in the median house value, and I would argue that investment-grade property is even less volatile.

The reality is that there isn’t one, homogeneous property market but in fact hundreds of different sub-markets that can behave differently.

Therefore, it’s possible that property in some locations can become so overvalued that they could crash.

Mining towns are a perfect example of this – prices in some locations fell by 70% in 2016.

In short, a crash in an investment-grade market is possible but highly unlikely.

Doomsayers are perennially wrong

There will always be property skeptics.

These predictions are made regularly.

I estimate that there’s been at least one major “crash” prediction made each year since I’ve started ProSolution in 2002.

I don’t think it will ever change.

But at some point, you must stop listening to attention-grabbing headlines and follow an evidence-based approach.

Today’s property prices will seem cheap in 2031

Mentally, it’s difficult to get your head around how powerful compounding growth can be.

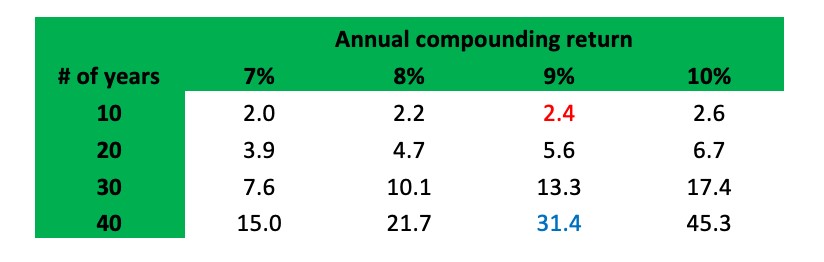

The table below illustrates this.

If you invest $1 million for 10 years and receive a return of 9% p.a., your investment will be worth 2.4 times more (the red number) i.e. $2.4 million.

If you retain that investment for 40 years, your investment will be worth 31.4 times more (the blue number) i.e. $31.4 million.

The best way to reduce your risk of entering a seemingly “expensive” property market is to buy a property that has the highest likelihood of generating the highest possible capital growth rate.

As the above table demonstrates, you can double your return if your property can generate 9% p.a. versus 7% p.a. over 40 years.

A relatively small increase in growth rates can have an unexpectedly large impact over many decades.

Buy the ‘right’ property and play the long game

The best response to any concerns about property prices is to level up on a property’s quality and focus firmly on long-term outcomes.

As a staunch proponent of evidence-based investing, you must apply a rules-based approach to selecting an investment-grade asset (there are three attributes for a property to be considered investment-grade, as explained here).

But also, since the property is part-art, part-science, it’s critical that you get advice from a local area expert.

ALSO READ: Australia’s hot property markets showing the fastest annual rate of growth on record

Stuart was a Chartered Accountant before establishing mortgage broking firm ProSolution Private Clients. He has authored two books and shares his experience with readers of Property Update. Visit www.prosolution.com.au

[ad_2]

Source link