[ad_1]

Please use the menu beneath to navigate to any article part:

What an unimaginable 12 months it’s been for property prices round Australia.

What has prompted this once-off-type occasion that has seen property prices soar, with no sign of ending?

Rewind 12 months and we have been purported to be seeing a fall of anyplace between 20% – 30% in our home prices.

Surely this “perfect storm” can’t proceed. As the well-known saying goes, this too shall move.

But when and the way is extra of an unknown.

So, what have been the occasions that led to this growth, and the way may it finish.

Here are my ideas…

Employment

Whether you’re a fan of the Government or not, the extent of stimulus to maintain Australians in work and hold the financial system afloat has been unprecedented.

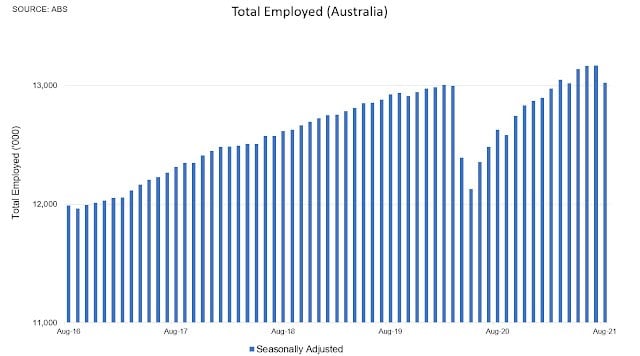

While there was a pointy drop within the variety of unemployed in the midst of final 12 months, now we have now returned to even greater ranges of employment than earlier than the pandemic.

There is little question there are numerous companies which are nonetheless hurting and a few individuals have misplaced their jobs whereas others should not working as many hours as they want, however from an enormous image perspective, we’re doing OK as regards to jobs creation.

Thankfully, this is in stark distinction to what many have been predicting would occur and why I might recommend many commentators predicted the worst.

Demand

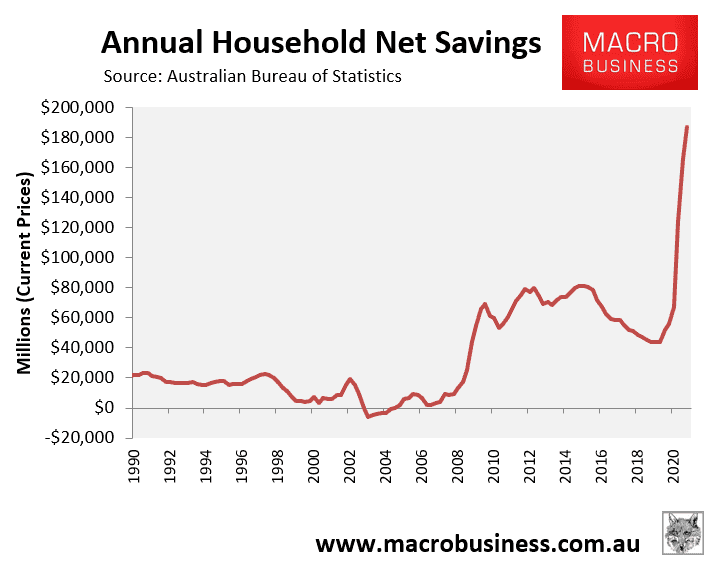

Australians spent greater than $62 billion on worldwide journey in 2019 and virtually $65billion in 2020, and that has clearly dropped like a stone.

As a outcome, in response to the ABS, Net Savings have skyrocketed to unprecedented ranges, whereas Australians have additionally paid off big quantities of bank card debt.

There was the prediction that demand for the property would drop as soon as our borders closed, nevertheless with almost 500,000 expats returning to Australia that has not eventuated.

Interest charges have additionally remained very low, with no indicators of rising over the quick time period so many present householders are upgrading.

Armed with better job certainty, above regular charges of financial savings, and entry to low-cost cash there isn’t a doubt residential property has been a serious precedence.

According to REA, demand has doubled in lots of capital cities.

Supply

While document ranges of demand are on one aspect of the equation, a scarcity of inventory has additionally created an issue for consumers.

Across the nation inventory ranges have been down considerably and round 20% on common.

While consumers have clearly been desirous to get into the market, it’s the sellers which are much more reluctant to promote.

This could possibly be as a result of merry-go-round of the market and lockdown uncertainty.

So, with record-high demand and provide of property at unprecedented lows, the elements are ripe for sturdy capital features.

So, when will it finish?

What occurs subsequent?

I imagine that something is feasible, as now we have all seen within the final 12 months.

But, in my thoughts, there’s a mixture of three issues that might and finally will cease this property cycle.

Firstly, market forces will gradual development as inventory ranges return to some normality as lockdowns ease and purchaser demand dissipates as pent-up demand is soaked up.

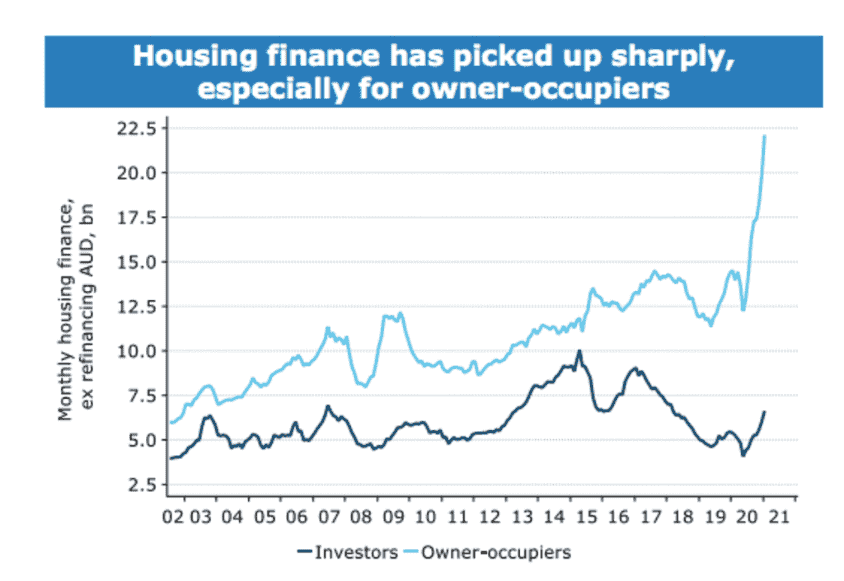

But with housing finance via the roof, this may take a substantial period of time regardless of inventory ranges bettering.

Prior to the Delta outbreak in Sydney and Melbourne, there have been some predictions that rates of interest would rise sooner relatively than later.

But with these lockdowns additional hurting the financial system, the banks and the RBA haven’t flagged a change till at the least 2023 or 2024.

APRA and the regulators may even have a big affect on this cycle as we noticed towards the tip of the final decade.

In the previous, they solely turned concerned as soon as they turned involved in regards to the stability of the banking system – for instance when the share of traders begins to rise above the longer-term common of round 37% mark.

While traders begin to change first dwelling consumers, they nonetheless solely make up round 30% of the market.

Conclusion

Come to the beginning of 2023 there may be the potential that we’ll be in a really completely different financial surroundings.

Our financial system must be in a stronger place and the urge for food by the RBA for rate of interest rises could also be on the playing cards as some banks have predicted.

Investors are likely to arrive late in property cycles and as investor numbers proceed to rise, APRA could intervene as they’ve completed up to now.

A full 12 months might also see consumers’ appetites and funds beginning to dry up and extra certainty will probably see inventory ranges return to regular.

In all chance, most of those elements will probably gradual and stall the momentum of our property markets across the nation.

Now I can’t see property values falling at that stage – at the least not for well-located A grade houses and funding nice properties

But for now, the perfect storm will proceed.

READ MORE:

A property year like no other – what’s been driving property price growth?

[ad_2]

Source link