[ad_1]

Key takeaways

The Labor party’s recent Federal Election win brought about a raft of new policy measures designed to address the property market’s biggest issues, including increasing housing affordability and making it easier for first-home buyers to get onto the property ladder.

The federal government’s Help to Buy scheme aims to assist first-home buyers with both the deposit and mortgage repayments, propelling buyers into the property market earlier and helping those who may not be able to buy otherwise.

The government will have an increasing stake in the property market and will benefit from capital growth, but home buyers can buy back stakes when they become financially sound.

The Coalition introduced the First Home Loan Deposit scheme to address affordability and home ownership constraints. Buyers can avoid paying Lenders’ Mortgage Insurance (LMI) by making a 5% deposit.

The HTB scheme allows buyers to enter the property market as much as 11 years and 5 months earlier than the FHLD scheme and reduces mortgage repayments. However, Domain recommends that homeowners dedicate less than 30% of their income towards mortgage repayments to avoid “mortgage stress”.

The Labor party’s recent Federal Election win brought about a raft of new policy measures designed to address the property market’s biggest issues.

Housing affordability and ownership have become an increasingly important issue for governments to address after record house prices pushed the idea of owning property out of the reach of many first-home buyers on low- to mid-level incomes.

Sydney house prices rose 40% from the trough in June 2020 through to March 2022, providing the steepest upswing on record, Domain’s inaugural NSW Spotlight report reveals.

And while prices in many NSW areas have peaked, and are expected to fall further this year, many buyers will still find the prospect of owning a home difficult.

But the change in government and its new buyer incentives may change all that, making it much easier for many first-home buyers to get onto the property ladder.

Help to Buy (HTB) scheme

The federal government’s Help to Buy (HTB) scheme aims to assist first-home buyers with both the deposit and mortgage repayments, propelling buyers into the property market earlier and helping those who may not be able to buy otherwise.

Here’s how it works and the criteria:

- Government helps with up to 40% of the purchase price of a new home and up to 30% for an existing home.

- Individual applicants must earn $90,000 or less or $120,000 for couples.

- Caps on property prices vary from $600,000 to $950,000 depending on the NSW location.

- Have a minimum 2% deposit.

- 10,000 available spots from July 2022.

- Must be a first-time homeowner and live on the property.

As time goes on, the government will have an increasing stake in the property market and benefit from capital growth once the property is sold.

However, the home buyer can purchase back stakes when they become more financially sound, at a 5% minimum.

If the homeowners’ annual income exceeds the earning caps for two years in a row, they will be required to buy back the government’s stake in the property in part or whole, the report explains.

First Home Loan Deposit (FHLD) scheme

The Coalition also introduced the First Home Loan Deposit (FHLD) scheme to address affordability and home ownership constraints.

First-home buyers can purchase a home with a 5% deposit (or 2% for single parents) with the government acting as a guarantor for the remaining so buyers can avoid paying Lenders Mortgage Insurance (LMI).

There are similar minimum requirements set out in order to qualify for the scheme, including income limits and deposit requirements, and the home must be your place of residence.

The advantages

The major advantage of the HTB and the FHLD schemes are the significant differences in the time it takes to save for a deposit but the HTB scheme also assists in reducing mortgage serviceability.

In its report, Domain has calculated the time it takes to save a deposit based on the best scenario, a buyer at the upper limit of the income threshold.

The HTB scheme allows an individual on a $90,000 salary to enter the property market as much as 11 years and 5 months early.

Couples on a $120,000 salary can access the property market as much as 8 years and 1 month early thanks to the scheme.

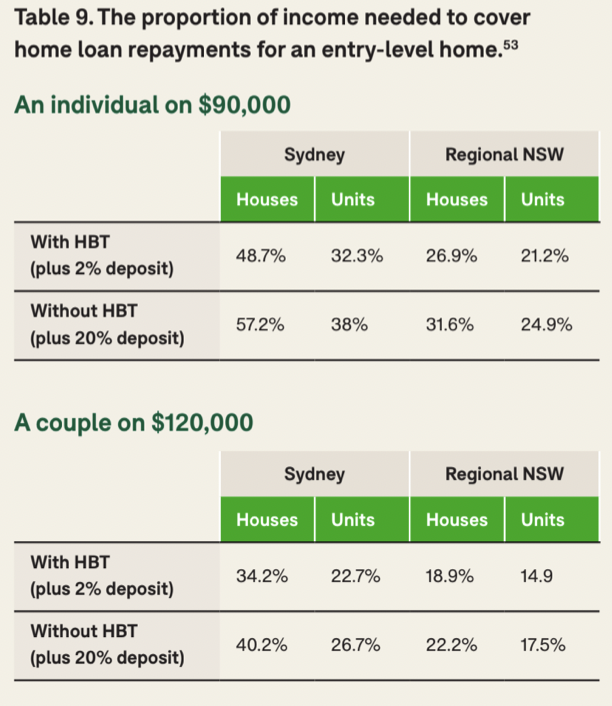

Another selling point of the HTB scheme is that buyers don’t need to loan as much as the government funds part of the purchase would reduce home loan repayments.

But, Domain recommends that homeowners dedicate less than 30% of their income towards mortgage repayments to avoid “mortgage stress”.

The HTB scheme dramatically reduces the proportion of income needed to cover home-loan repayments but mortgage stress concerns remain.

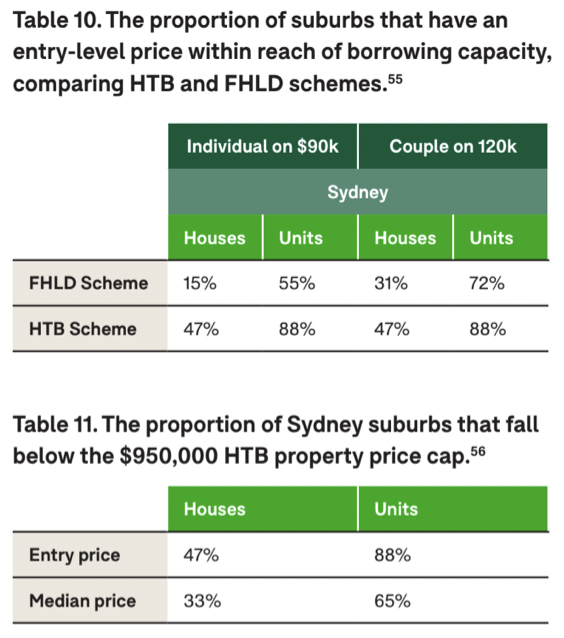

The significant bonus of the government’s assistance means that eligible buyers will have access to a much broader range of suburbs as the government essentially acts to boost first homebuyer purchasing power.

The scheme puts as much as 88% of suburbs within reach for individuals or couples looking to buy a unit, or as much as 47% of suburbs within reach if a house is what they’re after.

A final thought

First home buyers would need to carefully consider both of the government’s new schemes before applying.

After all, if something is too good to be true, it usually is.

The main concern is the financial implications of participating in a shared equity scheme.

The property will be partly owned by the government but that is still debt that will need to be paid back at some point in the future.

So applicants must be aware of how much debt they would be taking on under the scheme and consider the affordability of repayments.

Steffi Sendecki is a Property Strategist at Metropole with a background in Wealth Management assisting high-net-worth individuals and families achieve their financial and lifestyle goals through the provision of strategic investment advice.

[ad_2]

Source link