[ad_1]

Please use the menu below to navigate to any article section:

News that the Federal Government plans to expand its home loan guarantee scheme to allow more first-home buyers to step into the market without a 20% deposit or lenders mortgage insurance (LMI) was likely music to many people’s ears.

Because using the government’s First Home Loan Deposit Scheme, now rebranded as the Home Guarantee Scheme, young buyers are now able to dramatically reduce the amount of time it takes to save for a house in a capital city to just one year and one month.

Without the government initiatives, it would take the average Australian 4 years and 5 months to save enough to buy an entry-level house.

But there’s a catch

In order to qualify, single applicants can only have earned a taxable income of up to $125,000 per year for the previous financial year, and couples only up to $200,000.

It also has to be a home to live in, not an investment property.

And the biggest limitation is the property price cap – and this varies depending on where a buyer is planning to buy and whether it is a new or existing property.

For example, the property price cap in order to be eligible in Sydney is $800,000.

Meanwhile, properties $700,000 and under qualify in Melbourne, $600,000 and under qualify in Brisbane, and in Hobart, Canberra, Perth, Darwin, and Adelaide the price cap is just $500,000.

And median house prices sit substantially higher than this.

The median dwelling price for Sydney in April is $1,403,154, according to Corelogic data.

That’s significantly more than the $800,000 threshold.

And it’s the same story throughout all the other cities also.

If prices decline, this could free up more dwellings for applicants, while the reverse is true if prices continue to rise.

So where can you buy a property using the home loan guarantee scheme?

Domain has put together a list of qualifying suburbs in each Australian state.

Where you can buy a house in Sydney

Finding any house under $800,000 in Sydney is tough and while the suburbs with median house prices in this range are all in the western or south-western suburbs, some are less far-flung than others.

Glenfield, with a median price of $771,500, is 31 kilometres, or about a 45-minute drive, from the city centre, while Doonside, with a median price of $761,000, is 33 kilometres out – about a 40-minute drive.

But if it’s a unit you’re after you can look much closer to the city.

There are plenty of suburbs with median unit prices within the cap limit, from the upper north shore to the inner west, the south and even the city centre, although they will be closer to the $800,000 mark than suburbs further out.

While units in Wiley Park and Lakemba have median prices of less than $400,000, first-home buyers will find units in central locations such as Ultimo, only 1.6 kilometres from the CBD, and Leichhardt, just 5.2 kilometres away, or Hillsdale, in the eastern suburbs and 9.4 kilometres from the city centre.

Where you can buy in Melbourne

Finding a house under the government’s price cap of $700,000 is also a stretch in Melbourne, and many of the suburbs within that price range are a fair distance from the city centre.

For houses, Sunshine North is the closest eligible suburb with a median house price of just under $700,000, is only 13 kilometres from the CBD and is about a half-hour drive in the car.

St Albans is another five minutes away by car but cheaper still, with a median price of $668,000.

The mass exodus of international students from Melbourne’s CBD as the international borders closed during the pandemic, as well as locals who fled the locked-down city to regional areas, saw unit prices fall in some inner-city locations last year.

This means that West Melbourne, St Kilda West, Brunswick West and Glen Iris all had price falls last year, placing them well under the $700,000 cap.

Cremorne and South Melbourne, both within walking distance of the CBD, have median unit prices under $700,000.

Where you can buy in Brisbane

But today that has shot up to $856,731.

But the good news for Brisbane buyers is that Hemmant, in Brisbane’s eastern suburbs, has a median house price of less than $600,000 – and it’s just 10km from the CBD.

Other options include Acacia Ridge on the south side, Fitzgibbon on the north side, and Capalaba and Thorneside, also in the east.

And then when it comes to finding a unit under the price cap of $600,000, Brisbane first-home buyers are spoilt for choice.

Some of the city’s most sought-after suburbs, including Ascot, Paddington and St Lucia, all have median unit prices under the $600,000 cap.

Where you can buy in Perth

The latest Corelogic data shows that Perth’s median house price now sits at $568,108, which isn’t a far cry from the $500,000 cap, meaning most houses will be in reach.

Better yet, many of the suburbs that fall on or under that $500,000 cap are within close proximity of the CBD.

West Perth and Highgate are within walking distance of the CBD, and suburbs like Belmont and Osborne Park are less than 7 kilometres from the city centre.

Where you can buy in Adelaide

Adelaide was a little slower to boom than the east coast capital cities but once it got going it remained one of the best performing capital city property markets.

The supply of new housing stock for sale is very tight at a time when competition for property remains strong.

The latest CoreLogic data reveals Adelaide’s median house price sits at $658,446.

A Home Guarantee Scheme cap of $500,000 goes nowhere near as far as it would have pre-pandemic, but there are still suburbs within 10 kilometres of Adelaide’s CBD where the house median sits below that price point.

Most of them sit west of the city centre, with suburbs like Lightsview, Kilburn and St Clair falling under the $500,000 mark, but it’s Ascot Park, south of Adelaide’s CBD, that is the closest in proximity to the city centre.

Family-orientated Mansfield Park with its large homes and leafy parks sits only 9 kilometres from Adelaide’s CBD.

Where you can buy in Hobart

Hobart property prices have been supported by strong demand and weak market supply.

Now the median house price sits at $791,587.

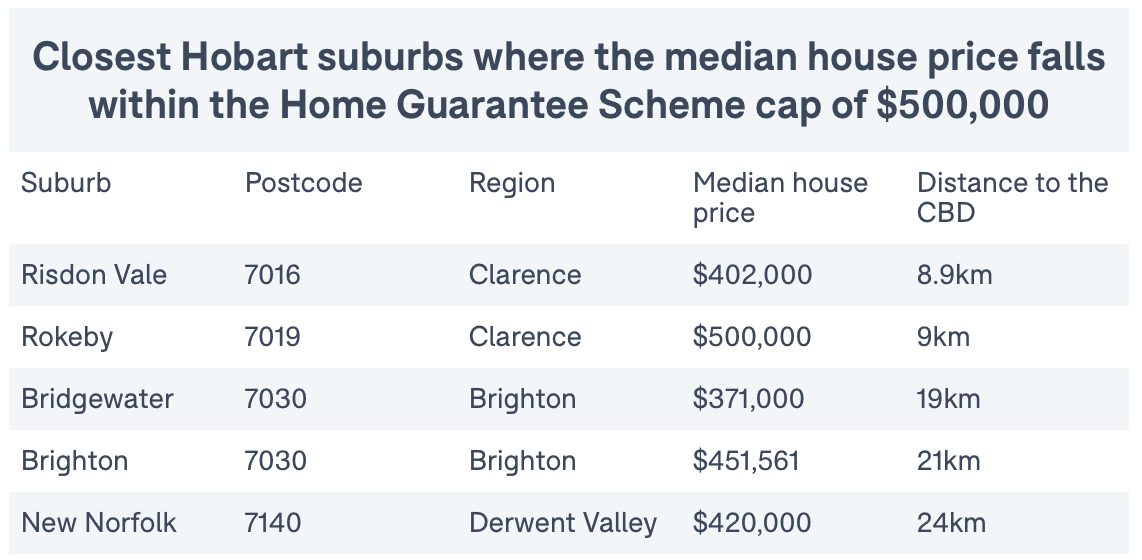

Domain data show the suburb closest to the CBD is Risdon Vale, closely followed by Rokeby, although the supply of houses currently listed for sale is slim.

Further out from the city centre are suburbs like Bridgewater, Brighton and New Norfolk, all with median house prices under $500,000.

[ad_2]

Source link