[ad_1]

Property prices across the country saw another increase in value last month, however, the rate of increase continues to slow down.

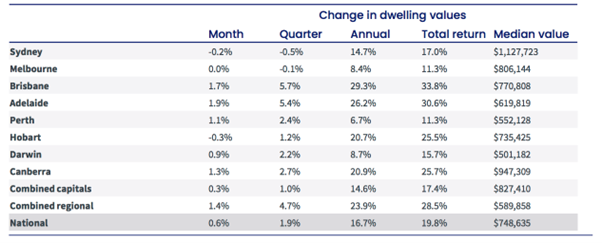

According to the latest data from CoreLogic, property prices increased 0.6 per cent in April, led once again by the smaller capital city markets.

Adelaide was the best-performed capital city in April, seeing values increase by 1.9 per cent, followed by Brisbane at 1.7 per cent and Hobart with a 1.3 per cent increase.

Property values in Sydney and Melbourne continue to slow down after an incredible 18 months of growth. Sydney home prices fell -0.2 per cent, Melbourne remained flat while Hobart has also posted a slight fall of -0.3 per cent.

Over the past 12 months, property prices are now 16.7 per cent higher, with regional areas outperforming, up 23.9 per cent.

Source: CoreLogic

CoreLogic’s Research Director Tim Lawless said rising interest rates have started to put pressure on homebuyers which is translating to slow price growth.

“With RBA cash rate set to rise, we are likely yo see a further loss of momentum in housing conditions over the remainder of the year into 2023.” Mr Lawless said.

“Stretched housing affordability, higher fixed term mortgage rates, a rise in listing numbers across some cities and lower consumer sentiment have been weighing on housing conditions over the past year. As the cash rate rises, variable mortgage rates will also trend higher, reducing borrowing capacity and impacting borrower serviceability assessments.”

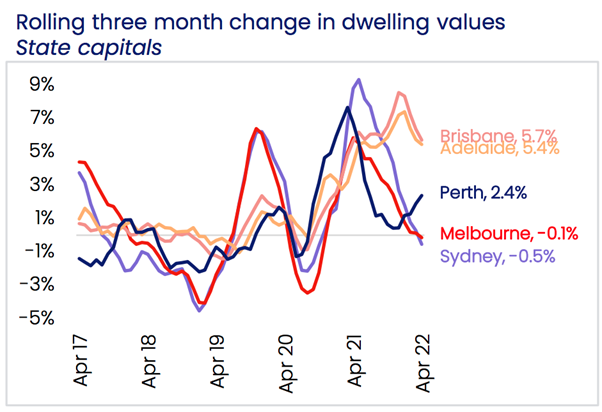

The Sydney and Melbourne markets have been the main two cities to see slowing price growth and had moved into negative territory on a quarterly basis for the first time since the 2020 lockdowns.

Mr Lawless said that while the smaller cities are currently still experiencing price appreciation, they too will likely see slowing growth in prices as high interest rates take their toll.

Source: CoreLogic

Listings Remain Low

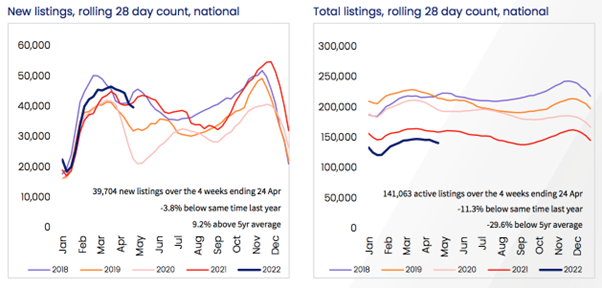

While price growth has weakened, one of the constant themes over the past few years that has helped push prices higher has been the lack of available stock on the market.

According to CoreLogic, advertised inventory, at a national level, is tracking almost 30 per cent below the previous five-year average. Total advertised inventory is more than 20 per cent below levels from a year ago in Brisbane and Adelaide, and around 40 per cent lower than the previous five-year average in both cities.

In weaker markets like Melbourne and Sydney, advertised supply levels have normalised. Sydney advertised stock levels are roughly in line with the previous five-year average, while listings in Melbourne were 8.2 per cent higher. Higher stock levels across these markets can be explained by an above average flow of new listings coming on the market in combination with a drop in buyer demand.

In Hobart, where April’s -0.3 per cent decline follows 22 consecutive months of growth, stock levels started to increase in the middle of March.

The new listing count is now 46 per cent higher over the four weeks to April 24 compared to the same period in 2021.

“With higher inventory levels and less competition, buyers are gradually moving back into the driver’s seat. That means more time to deliberate on their purchase decisions and negotiate on price,” Mr Lawless said.

Source: CoreLogic

Tight Rental Markets

Another key feature of the past few years has been a lack of rental stock and rising rental prices.

Just like overall property markets, rental markets are also seeing varying conditions according to CoreLogic. Nationally, rents were up 2.7 per cent over the three months to April, taking the annual change in rents to 9.0 per cent. A year ago, the annual change in national rents was 4.9 per cent.

House rents (+9.1 per cent) are rising faster than unit rents (+8.7 per cent). However, this trend is changing sharply as demand for unit rentals increases due to the higher cost of renting houses.

“On a rolling quarterly basis, we are now seeing unit rents rising faster than house rents, especially in Sydney and Melbourne where rental conditions across the unit sector were previously much softer.”

“The shift in rental demand towards units reflects both the rental affordability pressures, which are deflecting more demand towards the ‘cheaper’ unit sector, and the return of overseas migrants and visitors… Rental demand from overseas arrivals tends to skew towards inner city and high density precincts.”

Market Outlook

Property prices on a national level continue to ease with the peak put in place in March 2021 according to CoreLogic.

Prices have started to slow down in line with rising fixed-rate mortgages and with lower levels of affordability.

With the cash rate set to move through a rapid tightening cycle, CoreLogic expects the softening in the growth rate will become more pronounced over the coming months before the national index starts to trend lower.

“Although we are expecting the housing market to move into a downturn through the second half of the year, it is important to remember the context of the recent growth phase,” Mr Lawless said.

“Since the onset of the pandemic, national housing values have increased by 26.2 per cent, adding approximately $155,380 to the median value of an Australian dwelling.”

The RBA noted a 2-percentage point rise in interest could lower housing prices by 15 per cent, which would take property prices back to a similar level to where they were in April 2021.

CoreLogic believes the extent of any housing market downturn depends on how high and how fast the RBA raises interest rates.

[ad_2]

Source link