[ad_1]

Australian owners have cashed in on the highest level of profitability in a decade as an amazing majority of distributors recorded a revenue in accordance to Corelogic’s Pain & Gain Report.

More than 9 out of 10 house sellers bought for a achieve throughout the June quarter, a 9 per cent improve in contrast to the first quarter of the yr and the highest proportion of houses making a revenue since 2011.

Obviously the sturdy outcomes are on the again of our surging property markets, so this outcome isn’t a surprise.

CoreLogic analysed roughly 106,000 resales of residential actual property nationally, the place the newest sale date of the property occurred in the June 2021 quarter to see the proportion of housing re-sales that delivered nominal good points or losses for sellers.

This is up from 90.6% in the March quarter and is the highest level of profitability since the three months ending May 2011.

However, the tempo at which profitability is rising throughout the Australian housing market has began to sluggish.

This can be seen in the chart under, with exhibits a slight flattening in the development of profit-making sales.

The improve in the price of profit-making sales has coincided with a frequently sturdy surroundings for housing demand, which can also be mirrored in an uplift in sales volumes.

Nationally, the variety of resales analysed lifted round 9% in the June quarter in contrast with the preliminary depend of resales for March.

The variety of profit-making sales noticed for the quarter is roughly 97,000, up round 10% from the earlier quarter.

The nominal good points yielded from resales by means of the June quarter presently sit at $39.4 billion, up 12.6% from the earlier quarter.

However, the loss on sales totaled $1.1 billion, which additionally elevated in the earlier quarter.

Typical maintain intervals on all resales had been 8.8 years by means of the quarter, with median change in the preliminary and resale worth sitting at $236,000 in the interval.

Nationally, the median revenue on resales was $265,000 in the three months to June, whereas median losses had been -$43,000.

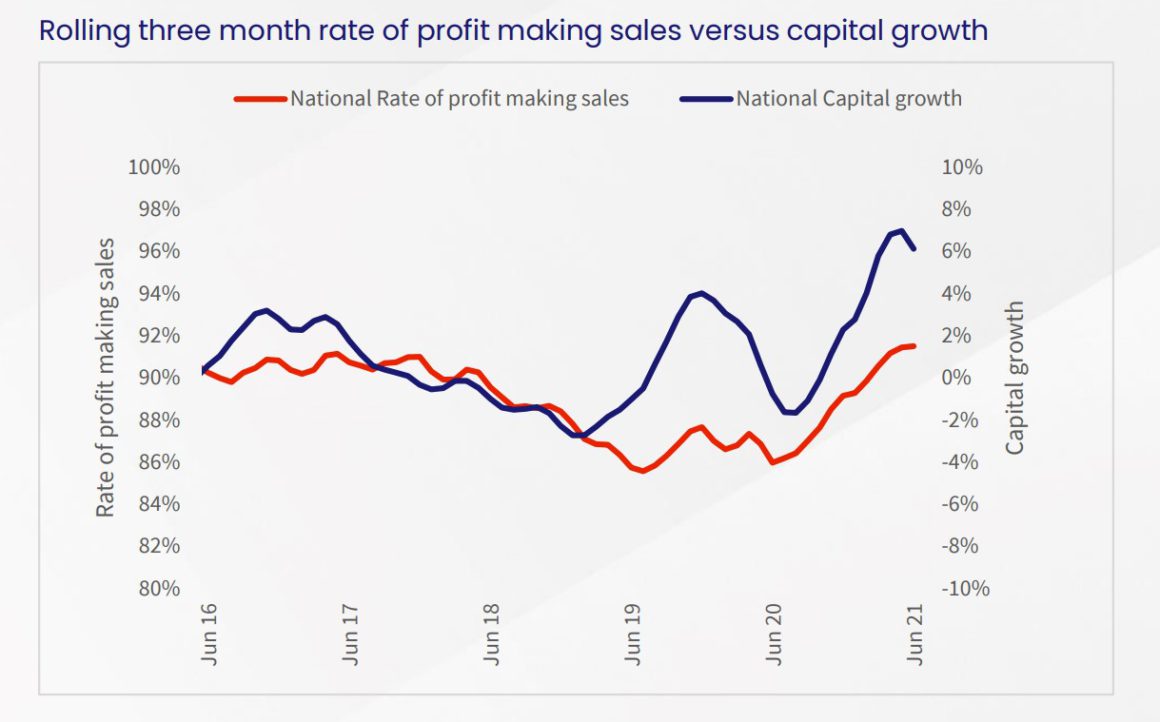

The development in profitability mirrors the development in capital development throughout Australian dwellings.

However, quarterly development charges, the tempo of worth will increase has additionally been slowing.

Australian housing values rose 6.1% in the June quarter, down from 7.0% in the three months to May.

A comparability of rolling 3-month development in Australian housing values towards the price of profitmaking resales is proven under.

The chart exhibits an uplift in the incidence of nominal good points rising with will increase in the worth of housing.

Given the tempo of quarterly capital development has slowed additional by means of to the three months to August (at 5.2%), the price of profit-making sales will doubtless additionally improve extra slowly when the September outcomes are analysed.

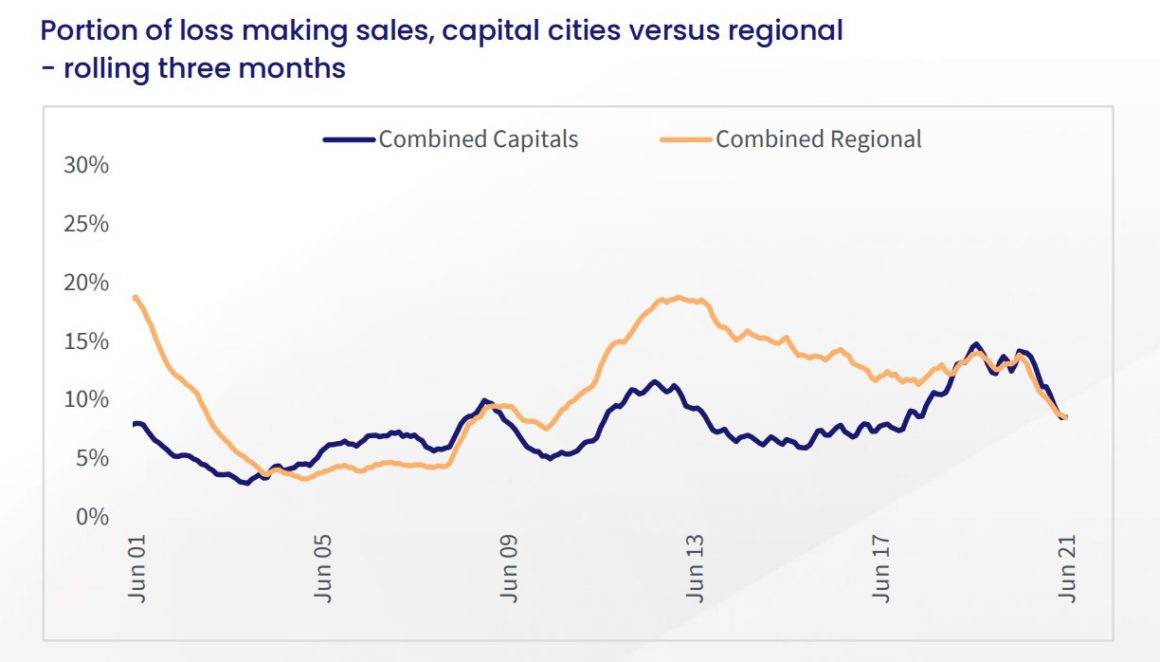

For the fifth consecutive quarter, the price of profit-making sales throughout regional Australia was increased than throughout the mixed capital cities.

This is down from a latest peak of 150 basis points in the September 2020 quarter.

It additionally mirrors capital development tendencies, which have seen a narrowing in efficiency between regional Australian and capital metropolis dwellings on a month-to-month foundation since early 2021.

The price of profit-making sales in the capital cities rose extra sharply by means of the June quarter, up 103 basis points from 90.4% in the March quarter, in contrast to an 81 foundation level rise from 90.7% throughout the mixed areas.

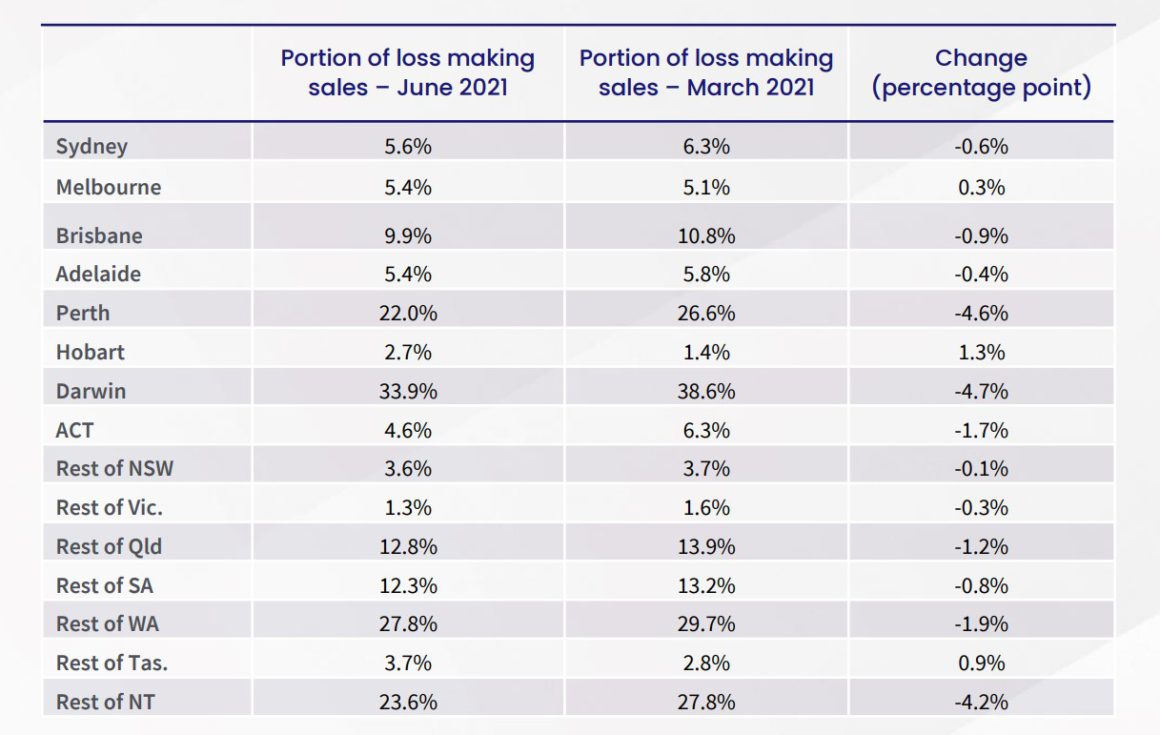

Across the better capital cities and ‘rest of state’ markets, the June quarter noticed a rise in profitability throughout 12 of 15 markets.

The price of loss-making sales elevated throughout Melbourne, Hobart, and regional Tasmania in the quarter.

The price of loss-making sales elevated throughout Melbourne, Hobart, and regional Tasmania in the quarter.

A abstract of the quarterly change in loss-making sales charges is offered in the desk under.

The price of loss-making sales throughout Melbourne rose to 5.4% in the June quarter, up from a revised 5.1% in the earlier quarter.

Despite the improve, Melbourne had the third-lowest price of loss making sales of the capital cities, behind Hobart (2.7%) and the ACT (4.6%).

Melbourne additionally had the sixth-lowest rank of loss-making sales nationally.

The largest improve in the price of loss-making sales was throughout Hobart, the place the portion jumped 1.3 proportion factors, albeit off a low base of 1.4%.

Despite the improve in the portion of loss-making sales throughout Hobart, it has maintained the lowest price in loss-making sales throughout the capital metropolis markets since January 2018.

Across regional Victoria, the proportion of loss making sales was simply 1.3%, down a additional 30 basis points on the earlier quarter.

The price of loss-making sales in this area was at a document low by means of the June 2021 quarter.

Notable reductions in the incidence of loss-making sales continued throughout the resource-based markets of Australia.

The price of loss-making sales fell over 4 proportion factors throughout Perth, Darwin, and regional NT in the June quarter.

The largest drop was throughout Darwin, the place the price of profit-making sales throughout all dwelling resales rose to 66.1% in the June quarter.

This is the highest price of profit-making sales seen in the metropolis since February 2018 and is up from a latest low, the place solely 45.3% of resales achieved nominal good points in the three months to July 2020.

Across Perth, the price of profit-making sales is at its highest level since June 2016.

This displays a continued restoration development throughout housing market values in these cities.

The June 2021 quarter marks the fourth consecutive improve in the price of profit-making sales nationally.

This follows the price hitting a latest low of 86.0%, amid stage 2 restrictions by means of the June 2020 quarter.

This is as a result of property values proceed to rise broadly throughout Australia, fuelled by resilience in client sentiment, ultra-low mortgage charges, subdued ranges of obtainable listings, and the reintroduction of presidency family help and mortgage compensation deferrals.

As with earlier intervals of lockdowns, sales and listings exercise have slowed markedly by means of the September 2021 quarter.

This means the quantity of profit-making sales could decline, at the same time as the price of profitability stays comparatively regular.

It is anticipated that the incidence of profit-making sales will decline when housing market efficiency begins to soften.

This would doubtless happen off the again of a change to lending circumstances, whether or not by means of will increase in the money price, or the introduction of macro-prudential measures round mortgage lending.

You is perhaps :

Pain and Gain Report September 2021: Houses vs. Units

Pain and Gain Report September 2021: Investor vs. Owner Occupiers

Pain and Gain Report September 2021: Sydney

Pain and Gain Report September 2021: Melbourne

Pain and Gain Report September 2021: Brisbane

[ad_2]

Source link

The price of loss-making sales elevated throughout Melbourne, Hobart, and regional Tasmania in the quarter.

The price of loss-making sales elevated throughout Melbourne, Hobart, and regional Tasmania in the quarter.