[ad_1]

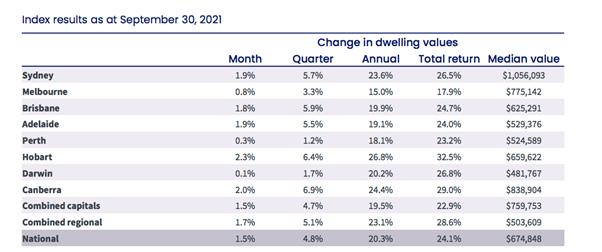

(*12*)House costs throughout Australia have continued their sturdy upward trajectory in September, with values rising 1.5%.

(*12*)The newest information from CoreLogic, paints a bullish image for owners, with dwelling values now 20.3% larger in the previous 12 months, which is a stage of development we final noticed again in 1989.

(*12*)Once once more, each capital metropolis in Australia noticed constructive development in September, with Hobart and Canberra as soon as once more the very best performers, rising in worth by 2.3% and a couple of.0% respectively. Sydney, Adelaide and Brisbane all noticed sturdy development of practically 2%, whereas Perth and Darwin have been the weakest capital cities with good points of simply 0.3% and 0.1%.

(*12*)Regional Australia can also be persevering with to see sturdy ranges of development and has outpaced its metropolis counterparts for an additional month. In October, regional areas grew by 1.7%, taking the annual price of development to 23.1% in what has been a stellar interval for housing exterior the large cities.

Source: CoreLogic

(*12*)Head of Research at CoreLogic, Tim Lawless says that regardless of a stable 12 months, development is slowing easing again from record-high ranges.

(*12*)“With housing values rising substantially faster than household incomes, raising a deposit has become more challenging for most cohorts of the market, especially first home buyers.”

(*12*)“Sydney is a primary instance the place the median home worth is now simply over $1.3 million. In order to lift a 20% deposit, the standard Sydney home purchaser would want round $262,300…”

(*12*)”Existing owners trying to improve, downsize or transfer dwelling could also be much less impacted as they’ve had the good thing about fairness that has accrued as housing values surged.”

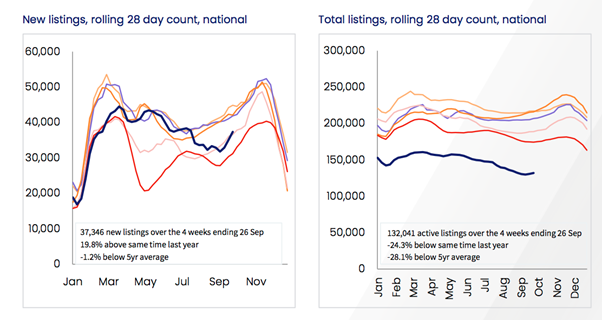

(*12*)Along with report low rates of interest, one other key ingredient in the present housing growth has been report low ranges of inventory highlighted by only a few properties listed on the market.

(*12*)Although new listings are slowly rising as we enter Spring, the development in complete listings stays low. Across the nation complete marketed provide ranges are -28.1% under the five-year common and each capital metropolis is recording a below-average quantity of marketed provide.

Source: CoreLogic

(*12*)Mr Lawless says that even with listings rising, we’re nonetheless in a vendor’s market.

(*12*)“Nationally, homes are selling in 35 days, up from 29 days in April, and vendor discounting levels remain around record lows at -2.8%. Another factor pointing to strong selling conditions is the bounce back in auction clearance rates as restrictions relating to one-on-one property inspections were eased mid-month across Melbourne and Canberra. By the end of September, the combined capitals clearance rate had returned to 80.5%, its highest since late March.”

Compressed Yields

(*12*)Thanks to the sturdy interval of capital development, rental yields have reached new report lows throughout most areas of Australia.

(*12*)Gross yields throughout the mixed capitals have fallen to three.0% in September, with gross yields in Sydney (2.5%) and Melbourne (2.8%) properly under the opposite capitals., whereas regional Australia is larger at 4.4%.

(*12*)CoreLogic means that, though yields are low, so too are investor mortgage charges. In July, the common three-year mounted price for a brand new investor mortgage was 2.38% whereas variable charges have been averaging 3.01%, suggesting there are alternatives for constructive money movement funding properties exterior of Sydney and Melbourne.

(*12*)Positive Outlook for Property Prices

(*12*)Overall, the development for home costs round Australia stays constructive in response to CoreLogic. Growth in housing values is being supported by an expectation that mortgage charges will stay at report lows for an prolonged time period, whereas sturdy demand is happening alongside persistently low marketed provide ranges.

(*12*)However, there are a variety of things on the horizon that traders want to pay attention to. While the RBA has made it clear charges are prone to stay low for an prolonged time period, we’ve not too long ago heard from APRA (Australian Prudential Regulation Authority) who’re taking a look at tighter debt-to-income ratios and the readdition of upper serviceability buffers, which may result in extra stress on these searching for new loans.

(*12*)Additionally, with lockdowns easing in the weeks forward, the expectation is that inventory ranges will proceed to rise for the rest of the 12 months, which has the potential to vary the buyer-seller dynamic that we’ve seen for the previous 12 months.

[ad_2]

Source link