[ad_1]

The price you pay for an investment property will only matter if you purchase the wrong asset.

An investment-grade asset will, in the long run, mask any purchase price errors that you may have made.

That is why focusing on the quality of the asset is easily the most important thing you must do when investing in property.

Simple math proves timing the market or buying below fair value is relatively meaningless.

Purchasing above or below intrinsic value

Let’s face it.

We all want to get the best deal we can, and no one wants to pay any more for a property than they have to.

It is my guess that the desire to buy well is driven mainly by two things; ego and misinformation.

Most people feel stupid if they subsequently realise that they overpaid for an asset – and none of us like feeling stupid.

The misinformation problem is that most people think the price they pay for an asset will have an impact on its performance.

But that is not true for investment-grade assets.

Show me the numbers

Anyone that has followed my blogs for any length of time knows that I love to dive into the numbers.

This topic is no different.

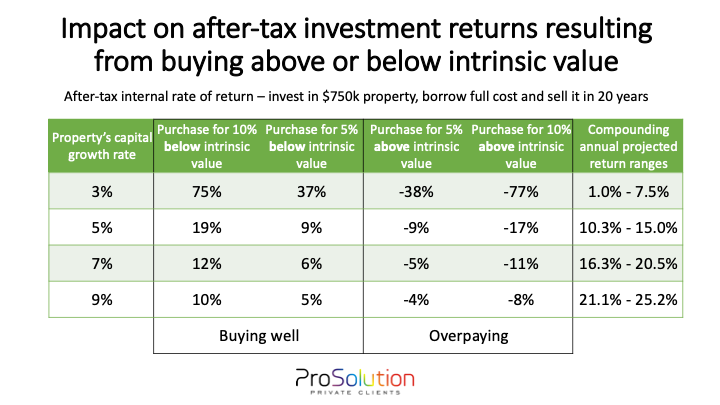

My findings are summarised in the table below.

I compared the after-tax compounding returns resulting from investing in a $750,000 property, holding it for 20 years, and then selling.

I assumed that you borrowed the full cost of this acquisition (including stamp duty).

The only cash you had to contribute to the investment is the holding costs i.e. the difference between the loan repayments and net rental income.

I then calculated the internal rate of return – which essentially is your annual compounding investment return after tax.

I then varied two assumptions:

- Whether the price you paid for the asset was above or below intrinsic value; and

- The average capital growth rate over the 20-year holding period.

The reason the investment returns ranges (far right column) might seem high, particularly for higher growth scenarios, is because of the impact of gearing i.e. you achieve relatively large returns for minimal cash contributed towards the investment.

What did I find?

If you purchase a property that has very low growth prospects e.g. 3% p.a. over 20 years, the price you pay for that asset will have a big impact on your investment return.

For example, if you purchase the asset for a price 10% below its intrinsic value (i.e. buy well), you improve your return by 75%.

Whereas if you overpay by 10%, you reduce your return by 77%.

But the important point is that the return range is relatively low i.e. between 1% and 7.5% p.a.

However, if you buy a high-quality asset that will deliver say 9% p.a. of capital growth on average over the next 20 years, it doesn’t really matter if you overpay.

For example, if you pay 10% too much, your return reduces by 8% – but you still achieve a compound annual return of over 21% p.a., which isn’t anything to sneeze at.

This data shows that the best way to mitigate risk is to level up on quality.

Great property for a fair price

Adapting a quote attributed to Warren Buffett, I assert that:

“I would much prefer to buy a great property for a fair price than a fair property for a great price”.

That’s because a high-growth asset will mask any purchase price mistakes.

Buying well (or not) will only impact your investment returns for one year (it’s a one-off event).

However, the quality of your asset will impact investment returns each and every year.

As such, you will remember (or be reminded of) an asset’s quality long after you have forgotten how much you paid for it.

Sometimes the desire to ‘buy well’ encourages investors to set their budget too low and as such, they repeatedly miss out on the opportunity to purchase high-quality assets.

This approach is misguided as the simple math above proves that quality is more important than price.

Price determines what you pay, quality determines what you receive.

What is a high-quality property?

A high-quality property is one that benefits from perpetually high demand but is infinite and short supply.

This is often referred to as an investment-grade property.

There are three critical attributes a property must exhibit to be regarded as investment grade being:

- It must have a long and stable history of above-average capital growth. That is, when you track past sales of the subject property and surrounding properties that are directly comparable to it, it should demonstrate that it has grown in value at a rate that exceeds the median for the capital city it is located within.

- By its very nature, the investment-grade property is predominantly (i.e. more than 50%) represented by land value. That is, the building value is less than 50% of the property’s overall value. This is necessary to ensure it has the long-term fundamentals that drive long-term capital growth. Land appreciates. Buildings depreciate.

- The asset must have two elements of scarcity. Firstly, it must be in a location that is highly desirable without any available vacant land for sale in close proximity i.e. scarcity of land. Secondly, the dwelling style must be in scarce supply. This excludes high-rise apartments for example. Small blocks of units typically build in the 1970s or earlier are good examples of scarce assets. Heritage architecture styles such as art-deco or Victorian are in finite supply and benefit from wide appeal.

Buying for less than intrinsic value is dependent upon luck

It is possible to purchase property for less than intrinsic value.

However, my thesis, from personal and professional experience is that the opportunity to do so is driven more by luck than anything else.

That is, you have to be in the right place at the right time.

As we all know, luck can strike randomly.

You might be lucky straight away and find a great property at a great price after only a few weeks of looking.

Alternatively, it might take many, many years, if at all.

In the meantime, the missed capital growth will cost you dearly.

Since I am only attracted to evidence-based strategies, I always counsel my clients to forget about trying to find a “good deal” and make friends with the fact that you may have to pay a fair value for an excellent asset.

But, of course, if a great deal pops up, you should be ready to jump on it.

Of course, if you are not actively in the market, you have zero chance of seeing any good deals.

P.S. Coincidentally, after writing this blog I came across the below quote by Warren Buffett’s 96-year-old longtime business partner, billionaire Charlie Munger. Charlie says price matters little when the asset is high quality:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns six per cent on capital over forty years and you hold it for that forty years, you’re not going to make much different than a six per cent return – even if you originally buy it at a huge discount. Conversely, if a business earns eighteen per cent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

Charlie Munger

This blog was originally published in July 2018 and has been republished for the benefit of our many new subscribers.

ALSO READ: 11 rules for successful property investing

Stuart was a Chartered Accountant before establishing mortgage broking firm ProSolution Private Clients. He has authored two books and shares his experience with readers of Property Update. Visit www.prosolution.com.au

[ad_2]

Source link