[ad_1]

Please use the menu beneath to navigate to any article part:

It’s been a troublesome 18 months for Australia’s economic system, and one which has seen buyers sit out of a soaring property market because the coronavirus pandemic smashed our shores.

But it appears there was a turnaround in sentiment with lending information displaying that buyers have begun to pile back into the market.

Investor loans have surged

While the worth of owner-occupier lending solely noticed average month-on-month features, investor lending has gone through the roof, up to $1.07 billion from April, in accordance to new ABS information.

Investor lending has now hit the very best stage since June 2015 with $9.13 billion of latest loans in May, greater than double the worth in May final 12 months when Covid-19 was in its early levels.

“Investor loan commitments have seen an unbroken period of growth since October 2020 and almost doubled in value compared to a year ago,” the ABS mentioned.

Not solely has the worth of latest loans to buyers virtually doubled since this time final 12 months, however the worth of investor loans has elevated in each state for the reason that pandemic started.

In Western Australia, Northern Territory, Queensland, and the ACT, the information reveals investor loans have doubled since March 2020.

Victoria bucks the pattern, nevertheless, because it noticed the extent of investor lending drop barely over June and July this 12 months, possible dampened by restrictions on property inspections because the state grappled with a Covid-19 outbreak.

And the ABS information is supported by what we’re seeing elsewhere additionally.

REA’s investor enquiries have elevated an enormous 90% over the previous 12 months to attain a stage not seen since early-2019.

Why the turnaround in investor sentiment

Because as focused stimulus fades and first dwelling patrons are as soon as once more all-but-shut out a booming market, investors have identified an opportunity to take over.

Recently Treasurer Josh Frydenberg introduced that the Covid-19 Disaster Payments will probably be wound down as soon as Australia’s states and territories hit the 70% double vaccinated price and halted altogether as soon as the 80% price is hit, so as to discourage states from reintroducing lockdown measures.

That’s simply weeks away for some states.

At the identical time, the rental market is extraordinarily tight in lots of elements of the nation, with rental value progress rising to the very best stage in practically 15 years – one more reason buyers are leaping back in with each toes.

Now we’re additionally seeing an ideal storm mixture of low borrowing prices, ongoing capital progress and engaging rental yields attracting buyers back into the market.

I feel booming home costs will continue to attract investors which can add demand to housing markets that are actually offering indicators of coming off peak progress charges.

Although rising affordability boundaries will act to side-line owner-occupiers – significantly first dwelling patrons, buyers typically don’t face the identical constraints.

Of course, our regulators are actually speaking about introducing macroprudential controls to sluggish our property markets down, however I can’t see that dampening investor enthusiasm.

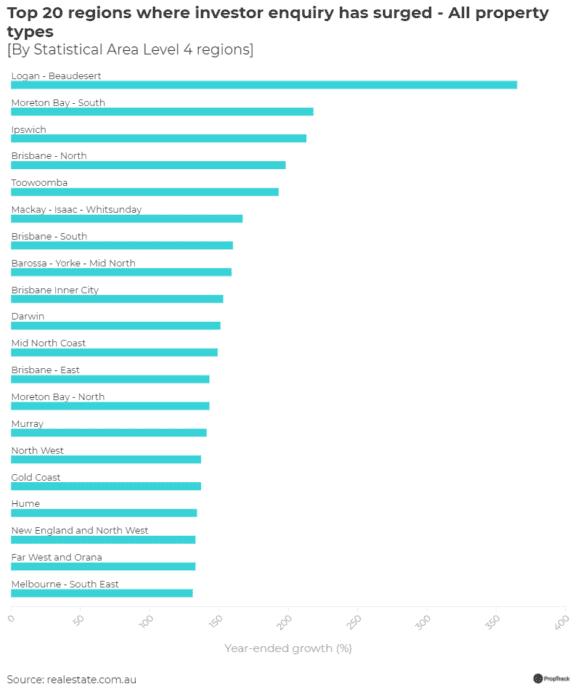

20 areas the place investor enquiry has rocketed

In explicit, Greater Brisbane, Darwin, and regional Queensland have all proven sturdy year-on-year will increase.

And by area, investor enquiry for all property sorts elevated probably the most in Logan, Moreton Bay, Ipswich and North Brisbane.

Not simply to be clear… I’m not suggesting these are good funding grade areas.

In truth, most of those will not be areas the place we might suggest buyers look.

While Brisbane has some nice alternatives lots of the different areas the place buyers are presently trying will see them disenchanted in a few 12 months’s time when the market finally turns and they’re left with secondary properties in secondary areas.

Looking particularly at enquiries for items, it appears buyers have properly and really shaken off any reservations they might have had of a perceived oversupply in Brisbane.

Realestate.com.au experiences that North Brisbane investor enquiries have elevated greater than 400% 12 months on 12 months, whereas south Brisbane and Brisbane’s inner-city are additionally seeing sturdy annual progress of greater than 200%.

Enquiries are up probably the most within the Logan-Beaudesert, Moreton Bay south and Ipswich SA4 areas, the information reveals.

Darwin and regional SA (Barossa – Yorke – mid-north) have additionally recorded massive will increase in investor e-mail enquiries.

Why?

Because relative affordability and tight rental markets seem to be piquing investor curiosity in these areas, REA says.

“South East Queensland and Brisbane property remain relatively affordable compared to the other East coast capital cities and yield advantages over NSW and Victoria have seen many looking for an opportunity in Queensland.”

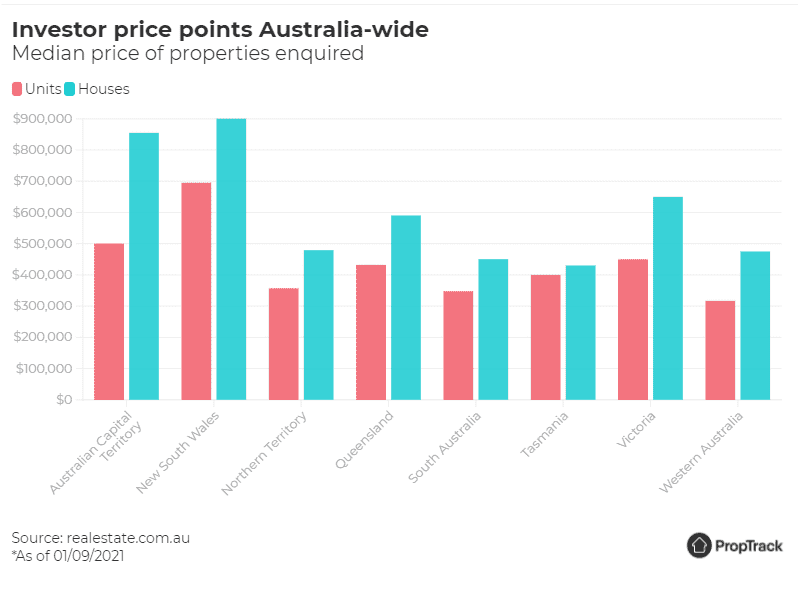

How a lot are buyers spending

The booming property market and sky-high costs will not be solely affecting owner-occupiers on the lookout for their first or subsequent dwelling.

The information additionally reveals that buyers are being compelled to enhance their price range so as to account for value progress throughout practically all markets and areas.

REA information reveals that the median price of home listings that buyers have been enquiring about has additionally steadily elevated since 2019, leaping 12% between January 2019 and August 2021.

And it’s the identical for items.

At a nationwide stage, the median price of unit listings enquired on by buyers rose 17% between January 2019 and August 2021.

Investor value factors are at their highest in New South Wales for each homes and items, whereas Tasmania has the bottom investor value level for homes and Western Australia has the bottom value level for items.

Interestingly, for the reason that pandemic hit Australia’s shores back in March 2020, the median price of unit listings within the Northern Territory noticed the largest enhance throughout the nation.

And new investor lending within the state has unsurprisingly adopted, doubling throughout that point as buyers reap the benefits of sturdy value progress and excessive rental yields, REA says.

READ MORE:

Is this the beginning of the end of our property boom? | Property Insiders [Video]

[ad_2]

Source link