[ad_1]

Please use the menu below to navigate to any article section:

If you sell a dud investment property, you may have to pay capital gain tax (CGT), selling costs and then stamp duty again when you reinvest… it can be a very expensive exercise!

And if you have owned the property for a while, it is probably putting money in your pocket each month (i.e. more than covering its expenses — no costing you anything) and the CGT could be significant — even more reason to not sell it, right?

This is what I would like to investigate in more detail.

In particular, how bad does the property’s performance need to be to warrant selling?

What is a dud property investment?

An investment-grade property should have an average growth rate in the range of 7% and 10% (or more) per annum over the long run (based on a historic inflation rate of between 2% and 3% p.a.).

Of course, the property’s value might not appreciate by this amount evenly every year — but you can average out the growth rate over a long period.

You need to have owned the property for 10 to 15 years for its past growth to be a reliable and meaningful indicator.

If you have owned the property for less than this, your “timing” potentially has a greater influence on its past growth as opposed to the actual fundamentals of the asset.

Therefore, if you have owned the property for less than 10 years you should compare its past growth to the ‘market’ i.e. how have similar properties performed over the same period.

Some sectors of the property market perform differently at different times as implied in this blog.

A dud property is one that has appreciated at less than 7% p.a. and/or not kept up with its peers.

What are the costs of making the change?

If you do decide to divest a property you need to consider the costs of doing so.

These include:

- Selling costs — including agent selling fees, marketing and advertising, any repairs that need to be made to get the property ready for sale and possible staging.

- CGT —multiply your gain by 23.5% and that will give you an estimate of the CGT you will have to pay. That is if you purchased a property for $400k and the purchasing costs were say $22k (stamp duty, legal fees, etc.) then the cost base is $422k. If you sell the property for $650k less $17k for selling costs, then your gross gain is $211k ($650k less $17k less $422k). If you held the asset for more than a year, you can discount the gain by 50% which brings it down to $105.5k and this amount is taxed at your marginal rate — let’s use 47% to be conservative = $49,585 of tax payable (being 23.5% of the gross gain).

- Purchasing costs — the stamp duty payable with respect to a replacement investment property plus any fee for asset selection advice (buyers’ agent fees).

My analysis

I have financially modelled the impact of selling a dud investment, paying the CGT and reinvesting in a higher quality property.

For this example, I assumed that the property was purchased in May 1991 for $141k and is now worth $650k which equates to a 5.8% p.a. growth rate.

The related loan balance is $145k.

The property’s rental income is $22,000 gross p.a.

Whilst the property is producing a positive cash flow after all expenses of circa $10k p.a., its growth rate has underperformed.

The median growth rate for Melbourne over this same period was 7.1% p.a. which includes all properties i.e. a lot of non-investment grade property.

Realistically, with astute asset selection, you should be able to beat the median return.

If the investor sells this property, they will have to pay for CGT — I estimate $115k — which is a lot of tax to pay!

However, if they do sell this property and reinvest in a better asset, the advantages are:

- they can use the after-tax cash proceeds to reduce their non-tax-deductible debt (home loan); and

- in the long run, a superior capital growth rate will generate significant value.

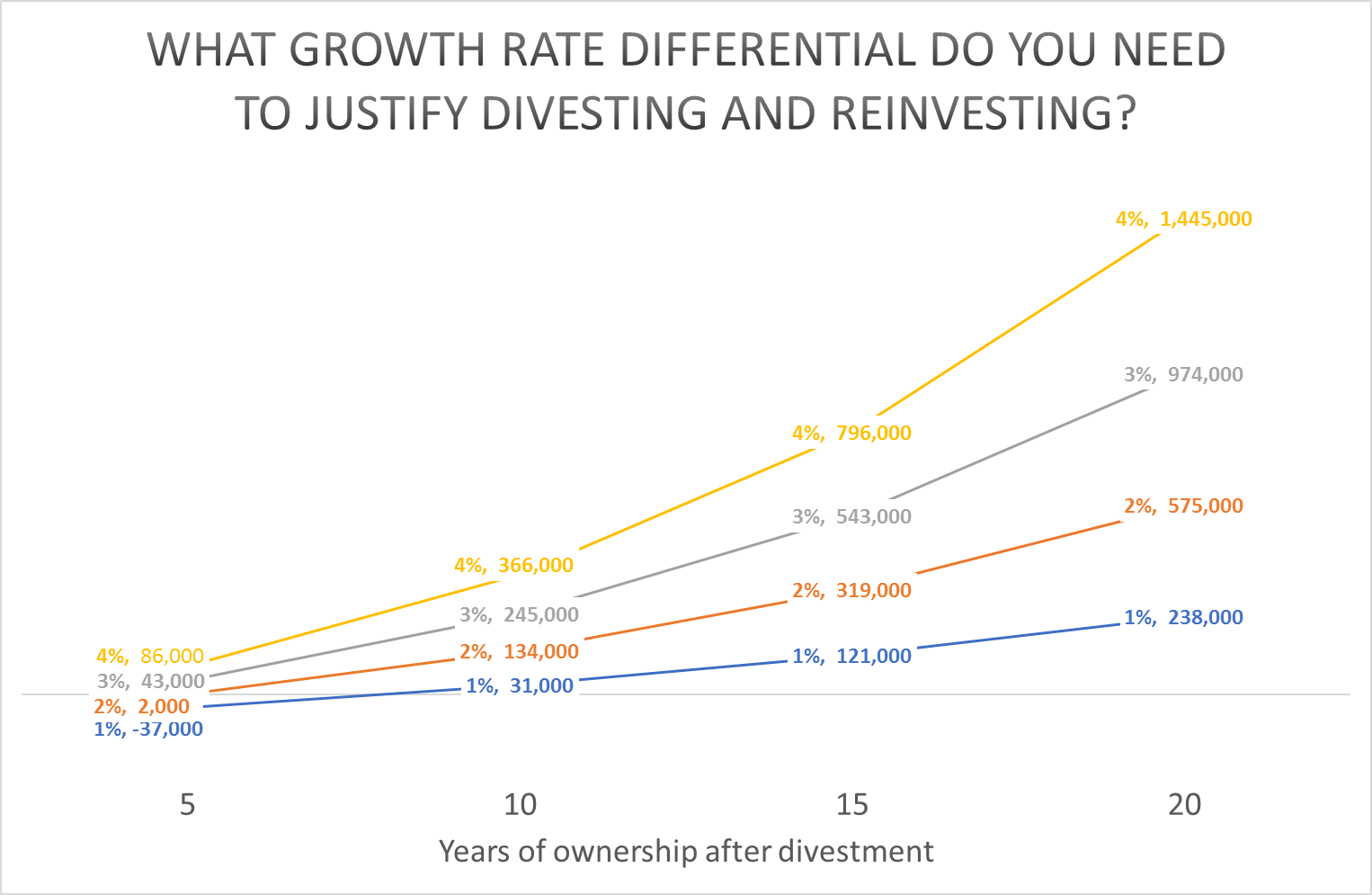

I financially modelled this scenario which is illustrated in the chart below (click to enlarge).

I explain this chart below.

What does the above chart tell us?

The chart projects the difference in overall wealth in today’s dollars (i.e. excluding inflation) after 5, 10, 15 and 20 years.

It measures the impact of a 1%, 2%, 3%, and 4% annual growth rate differential.

That is, what if the replacement property appreciates at 1% + 5.8% = 6.8%, or 2% + 5.8% = 7.8% p.a. and so on.

For example, if this investor divests of their existing asset and invests in a replacement property that grows at 7.8% p.a., after 15 years the investor will be $319,000 better off (net of all costs) in today’s dollars.

The financial model takes into account the impact on cash flow, the benefit of being able to reduce non-tax-deductible debt, the impact of various capital growth rates, and the opportunity cost and time value of money.

Essentially, what I am trying to ascertain is how much better does the new (replacement) property have to be to more than offset the costs associated with divesting and reinvesting.

As you can see from the above, the answer is that a performance of close to (or more than) 2% p.a. higher than your existing “dud” asset produces a superior financial result in the long run.

With financial decisions like this, you must think long-term.

The things you need to consider

This is only one scenario and of course, you should get personalised financial and property advice before making any decision to divest an asset.

Some things you need to consider include:

- The relative performance of your existing investment property and the length of time you have owned it. If the performance has been very poor over a long period of time, then the evidence is compelling. However, if the performance has just been “okay”, but not great and you haven’t owned the property for a long time then I’d probably advise you to hold onto it for a little while longer.

- The amount of your home loan and the amount of equity in the investment property to be disposed of. The advantage of selling an investment property with a lot of equity is that it allows you to reduce your home loan (which provides significant compounding savings). However, if your investment has little equity and/or your home loan is small, then it will have little impact.

- The amount of CGT. Let’s face it, no one likes paying taxes! It’s a bitter pill to swallow. If there is little CGT to pay, then the decision to divest a dud asset is somewhat easier.

- Your borrowing capacity and cash flow. You must consider your ability (and budget) to reinvest if you are to dispose of a dud asset. Therefore, you need to get advice on what your current borrowing capacity is having considering the bank’s parameters and your cash flow position.

This blog was originally published in July 2018 and has been republished for the benefit of our many new subscribers.

ALSO READ: 3 questions to ask before selling your investment property

[ad_2]

Source link