[ad_1]

Our capital city housing markets have continued to report strong results generally over February with no indication of a decline in buyer and seller activity.

The weekend auction markets have commenced the auction season with higher clearance rates overall compared to the results reported over the final months of 2021.

The Melbourne and Sydney markets have experienced notable revivals in February with Sydney recording near-boomtime clearance rates and Melbourne rates the highest for that market since last October.

Buyer and seller confidence remains high with a remarkable surge in auction activity to record February levels and well ahead of the same month last year.

Annual Change February 2022

| Sydney | Melbourne | Brisbane | Adelaide | Perth | Canberra | |

| Weekend Home Auctions | 38.7% | 8.9% | 123.5% | 127.8% | NA | 78.4% |

| Weekend Home Auction Sales | 23.2% | -1.3% | 154.8% | 128.4% | NA | 73.9% |

| Total Homes for Sale | 13.1% | 1.5% | -27.6% | -27.6% | 6.5% | -9.9% |

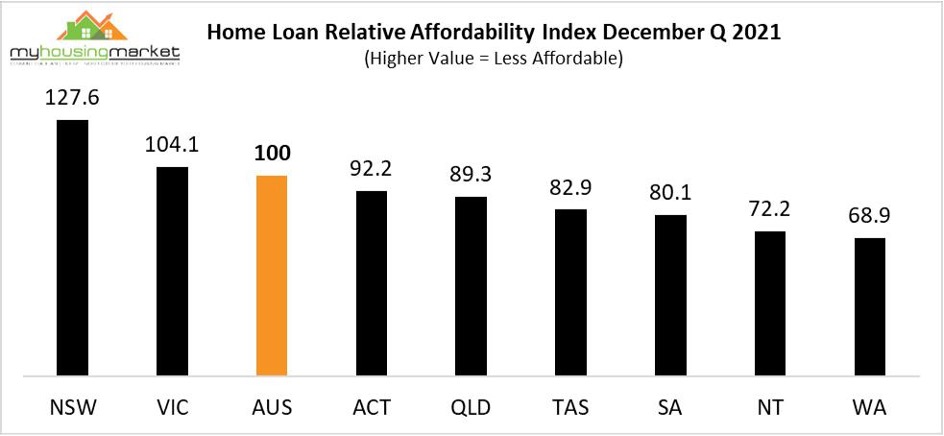

Despite strong buyer and seller activity, and clearance rates clearly still indicating a seller’s market generally, recent prices growth has produced mixed results – reflecting clear differentials in affordability levels between the capitals.

House price growth in Sydney and Melbourne has moderated over February however Brisbane and Adelaide continue to record strong results.

Booming house prices in Melbourne and Sydney rising to extraordinary annual levels over 2021 have predictably acted to significantly reduce affordability, with buyers – although still highly active in those markets – now constrained by flat interest rates and subdued incomes to continue to steeply bid up property prices as lending capacity has been maximised.

By contrast the smaller capitals – particularly Brisbane and Adelaide continue to provide buyers with affordability advantages as strong demand pushes up prices at similar extraordinary levels to those recorded by Melbourne and Sydney last year.

Housing market demand will continue be supported by the imminent reintroduction of mass migration and rising confidence in a post-covid recovering economy and reinforced by a clear underlying shortage of housing. Investor activity will also continue to support housing markets, with surging rents enhancing yields and supporting total returns.

The level of prices growth however will be determined by interest rates and incomes growth going forward which are likely to remain steady for the foreseeable future.

The consolidation of affordability in housing markets over time in a normalised economic environment with low interest rates and steady income growth will result in flatter house prices outcomes and a more predictable and sustainable housing market.

[ad_2]

Source link