[ad_1]

Rapid development in Australian housing values and rents over the previous yr has contributed to better affordability pressures for households.

Perhaps a more unusual consequence of the present housing affordability pressures is the anecdotes which have emerged round difficulties upgrading.

With Australian dwelling values rising 20.3% within the yr to September, some latest residence sellers have discovered it troublesome to re-enter the market as soon as they’ve offered.

The state of affairs poses a selected barrier for these seeking to improve from flats to homes, with nationwide home values growing 22.9% within the 12 months to September, in comparison with a 12.0% elevate in unit values.

Similarly, the hole between median home and unit values continued to pattern at report highs by September 2021, with typical capital metropolis home values sitting 34.4% larger than unit values.

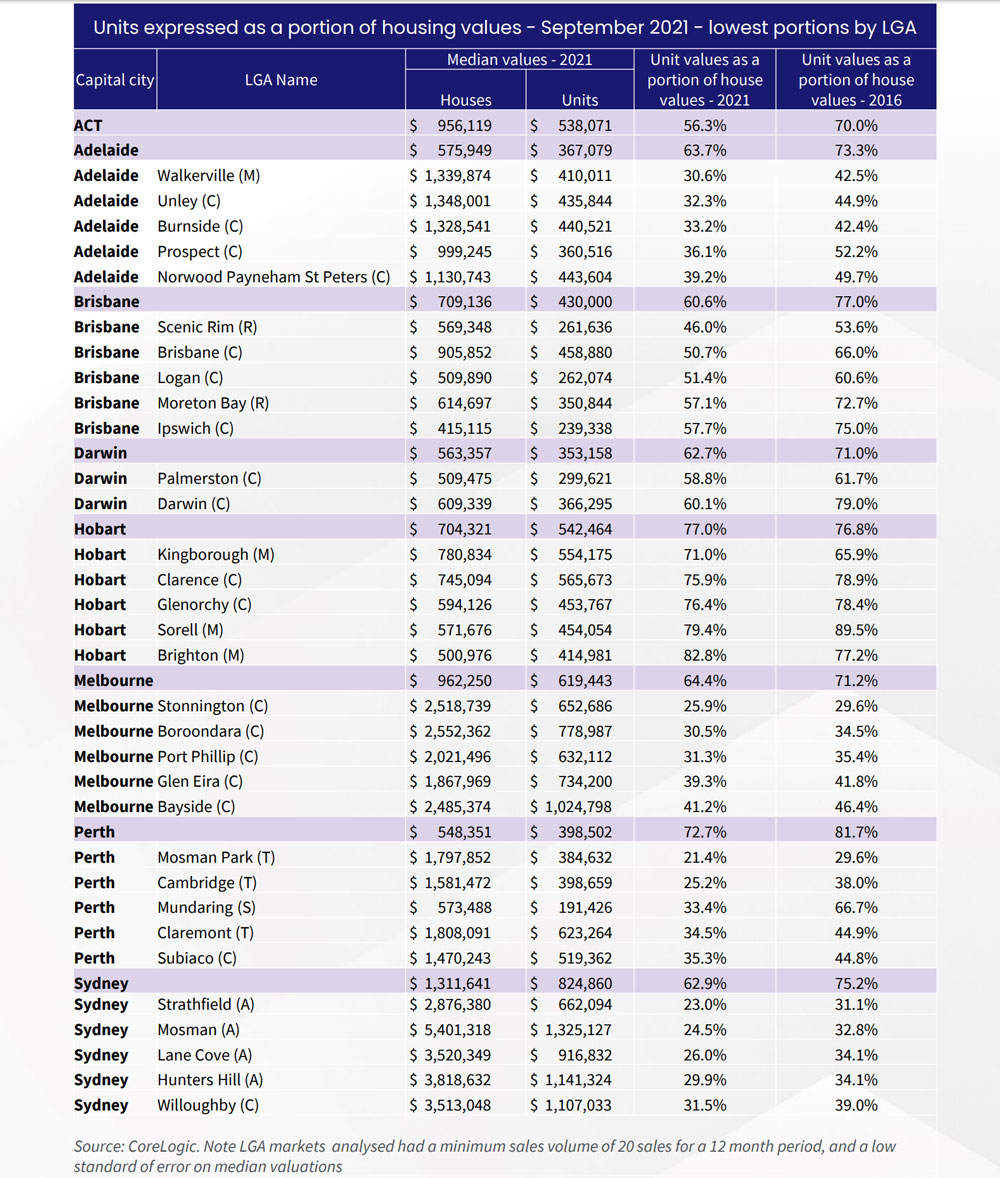

Extending on a latest evaluation that compares unit values to homes on the capital metropolis stage, the desk beneath highlights the native authorities areas throughout the capital cities the place median unit values would depend the least towards home values in the identical area.

In different phrases, the evaluation suggests which LGAs have the most important distinction between home and unit values, and will see the most important problem for apartment homeowners seeking to improve to homes in the identical space.

The pattern is most startling in Mosman Park in Perth, the place the median unit worth would account for simply 21.4% of the usual home worth – in different phrases, the total worth of a unit within the LGA could be just a little greater than a normal home deposit in the identical area.

Similarly, low ratios could possibly be seen throughout Strathfield in Sydney, the place unit values account for simply 23.0% of home values, and Mosman, at 24.5%.

A pattern on this information is that costlier dwelling markets, notably within the housing phase, are inclined to correlate with the least quantity of buying energy from items.

Many of those could possibly be thought of extra ‘desirable’ housing markets, together with these nearer to CBDs.

This is especially evident in Sydney markets like Strathfield (the place 64.6% of housing inventory are items) and Woollahra (61.4%), in addition to the Melbourne markets of Port Phillip (74.3%) and Stonnington (65.5%).

Higher concentrations of unit provide have probably put downward strain on development in unit values over time.

This dynamic will not be essentially dangerous for consumers; the flip facet of a decrease proportion of housing inventory is that there’s a larger density of comparatively low cost inventory, which accommodates better socioeconomic range for residing nearer to the CBD.

But wanting on the change in unit values as a portion of housing over time exhibits apartment homeowners within the present market would have the ability to put much less in the direction of a home than they might 5 years in the past.

LGAs throughout Hobart, Darwin, and Brisbane usually had decrease gaps between home and unit values, although there are probably completely different dynamics at play.

Across Greater Hobart, items are usually excessive in demand however low in provide.

Demand could also be attributed to a extra mature aged demographic wanting for downsizer or decrease upkeep choices, in addition to reputation amongst buyers.

CoreLogic estimates the overwhelming majority of Hobart items are owned by buyers, and items could also be in excessive demand because the short-term rental lodging markets maintain sturdy amid an uplift in home tourism.

In the previous 5 years, there has truly been a slight improve within the worth of items as a portion of housing values, suggesting the capability to improve could have truly improved.

ALSO READ: Why is Australian housing so expensive and what can be done to improve housing affordability?

[ad_2]

Source link