[ad_1]

With our property markets booming this yr a staggering variety of property house owners made a revenue on reselling in the June quarter of this yr in keeping with the latest Pain and Gain report.

CoreLogic analysed roughly 106,000 resales of residential actual property nationally, the place the latest sale date of the property occurred in the June 2021 quarter to see the proportion of housing re-sales that delivered nominal features or losses for sellers.

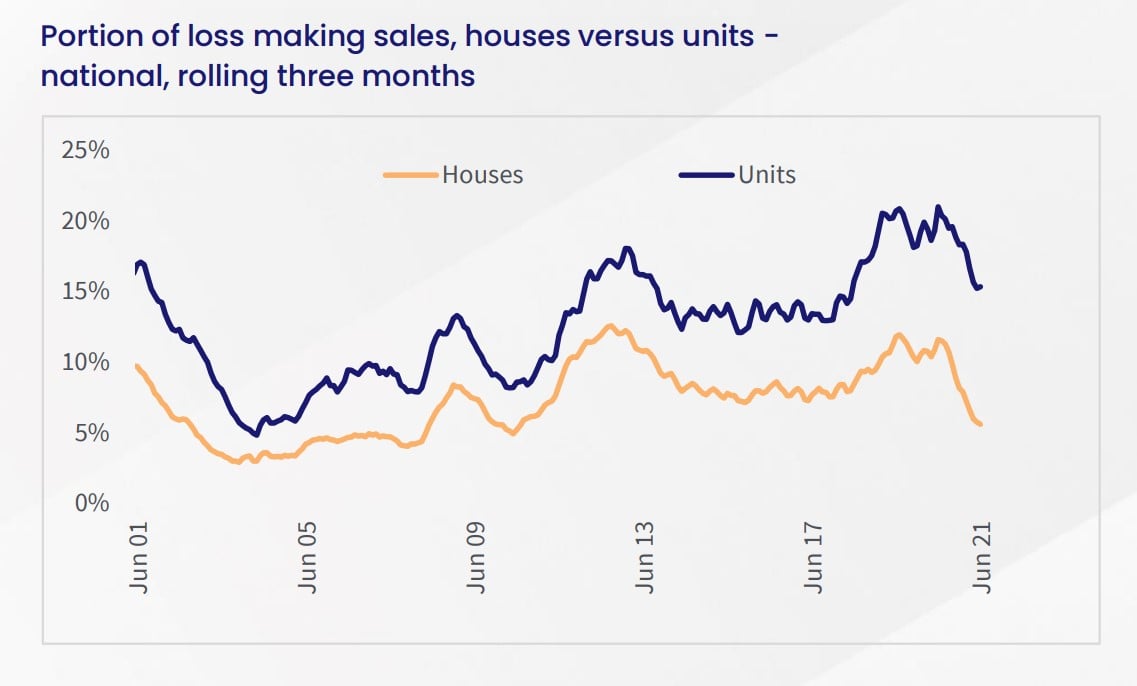

Profitability throughout each the home and unit market elevated with greater than 9 out of 10 dwelling sellers promoting for once more, although the incidence of loss-making gross sales remained considerably larger throughout the unit phase.

In the three months to June, 15.3% of items bought for a loss, down from 16.6% in the earlier quarter, and 21.0% from the similar quarter final yr.

This compares to a loss-making sale charge of 5.6% in the housing phase, down from 6.6% in the earlier quarter and 11.6% in the June quarter of 2020.

Comparing the charge of loss-making gross sales nationally with the earlier quarter means that profitability has improved quicker in the housing phase over the yr, however the unit phase has seen a higher discount in the portion of loss-making gross sales over the earlier quarter (with the charge of loss-making gross sales falling 127 basis points in the unit phase, in comparison with 97 basis points in the housing phase).

Despite the comparatively speedy enchancment in profitability throughout items, the charge of loss-making gross sales nationally stays round 2.7 occasions larger than in the housing phase.

The previous decade has seen a median differential of 6.3 proportion factors in the charge of loss-making gross sales between homes and items.

However, the incidence of loss amongst unit gross sales turned significantly elevated from early 2018, as proven in the chart above.

In addition to a better likelihood of nominal loss in the unit phase, homes have additionally delivered higher nominal features than items.

At the nationwide degree, the median revenue from home resales was $310,000, in comparison with $155,000 throughout unit resales.

Weaker profitability in items relative to homes comes off the again of modifications to unit demand, coupled with a rise in unit provide in current years.

Changes to unit demand partly stem from macro-prudential regulation in late 2017, which briefly restricted the portion of interest-only mortgage lending for property purchases.

Interest-only lending was disproportionately utilised by traders, and investor finance for the buy of housing declined -23.9% between the 2017 and 2018 calendar years.

Because investor demand skews extra towards unit purchases, this may increasingly have slowed the capital appreciation of some unit markets relative to homes.

Furthermore, demand has been significantly skewed towards homes over items since the onset of COVID-19.

This could also be the results of extra owner-occupier demand, in addition to extra time spent at dwelling by way of lockdowns triggering demand for bigger, indifferent residences.

This has resulted in an appreciation of home values nationally of 18.5% since March 2020, in contrast with a elevate of simply 9.0% in the unit phase over the similar interval.

Additionally, the fall in investor demand by way of 2017 and 2018 coincided with an uplift in unit completions.

Interestingly, there are early indicators that the tempo of capital progress in home values is at the moment slowing quicker than in the unit phase.

This could also be a results of rising housing affordability pressures in the indifferent home phase, the place mixed capital metropolis home values had been sitting 32.2% larger than items in August.

The elevated worth pressures throughout the housing market might even see extra consumers pivot to the unit phase in the coming months, and result in an elevated incidence of profit-making gross sales throughout items.

Characteristics of loss-making unit gross sales

Through the June quarter, there have been near 4,900 loss making-unit gross sales.

Unit gross sales accounted for 30.1% of resale observations in the June quarter, however a disproportionate 54.1% of all loss-making resales.

Almost 1 / 4 of loss-making unit gross sales (23.9%), had been concentrated in the three LGAs of Brisbane City Council, the Gold Coast City Council, and Melbourne City Council by way of the June quarter.

As a proportion of complete gross sales, loss-making items had been really proportionally decrease than the nationwide determine throughout the Gold Coast (11.2%).

The massive quantity of loss-making unit gross sales in this area was extra a operate of excessive gross sales volumes total.

However, Melbourne LGA has seen an uplift in the proportion of loss-making unit gross sales by way of the June quarter, at 39.0%.

This is up from 38.4% in the earlier quarter.

The quantity of loss-making unit gross sales reached a peak of 218 in the three months to May 2021 and has eased barely in the three months to June (203).

As mentioned in the earlier quarter, this extremely concentrated funding market has been disproportionately impacted by COVID-19, resulting from the closure of worldwide borders.

From March 2020 by way of the June 2021, lease values throughout items in the Melbourne LGA have fallen – 21.3%, and total unit values have elevated a comparatively subdued 3.3%.

Loss-making unit gross sales had been broadly confined to the suburbs of Melbourne, Docklands, and Southbank.

This coincided with a 5.0% rise in Brisbane LGA unit values over the 12 months to June 2021.

Across the LGA, the highest depend of loss-making unit gross sales was throughout the suburbs of Brisbane City, Fortitude Valley, and South Brisbane.

Despite inner-city areas of Melbourne and Brisbane seeing excessive volumes of loss-making unit gross sales, the highest proportion of loss from unit resales in the quarter was really throughout Perth LGAs, reminiscent of throughout Cockburn Council, the place 69.5% of unit resales made a nominal loss.

As famous in the earlier quarter, an absence of worldwide migration continues to weigh on rental markets throughout Melbourne.

The September quarter might present a rise in the proportion of loss-making unit resales throughout the Melbourne LGA, although volumes may very well be extra subdued resulting from lockdown situations throughout this era.

At the nationwide degree, the portion of profit-making unit gross sales is anticipated to regularly improve, in line with continued property worth will increase noticed by way of to August.

You may be :

Pain and Gain Report September 2021: National review

Pain and Gain Report September 2021: Investor vs. Owner Occupiers

Pain and Gain Report September 2021: Sydney

Pain and Gain Report September 2021: Melbourne

Pain and Gain Report September 2021: Brisbane

[ad_2]

Source link