[ad_1]

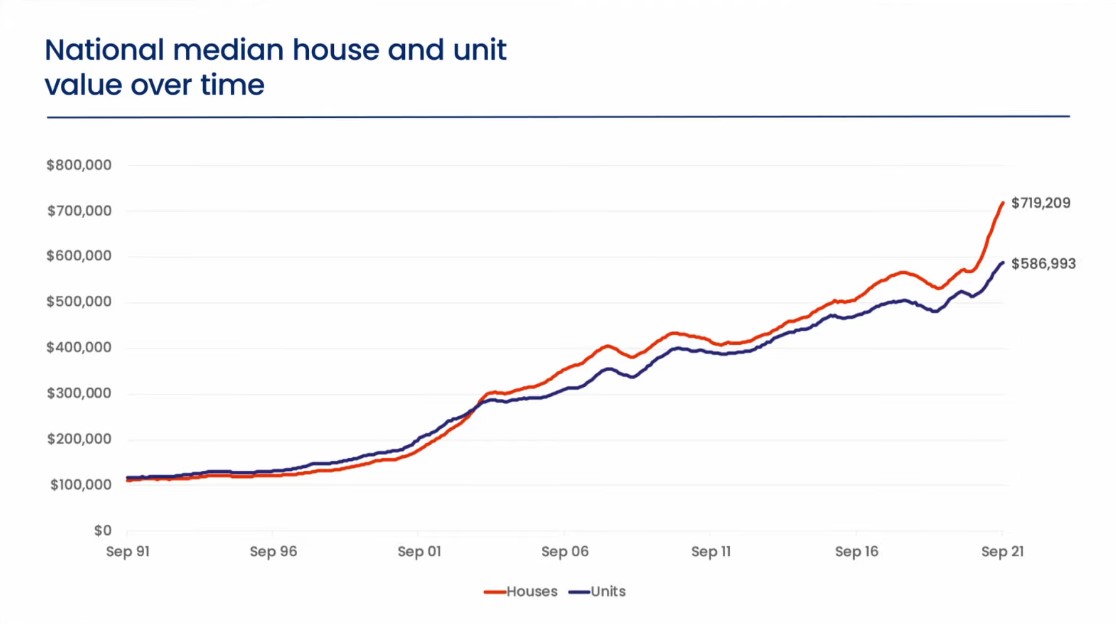

CoreLogic’s nationwide dwelling worth index rose one other 1.5% final month, taking Australia’s housing values 17.6% larger over the primary 9 months of the yr and 20.3% larger over the previous 12 months.

The annual progress fee is now monitoring on the quickest tempo because the yr ending June 1989.

The month-to-month change in housing values stays constructive throughout each capital metropolis and broad remainder of the state area, with Hobart and Canberra recording the biggest progress, whereas Darwin and the just lately revised Perth index recorded the softest progress circumstances throughout the capitals.

Across regional Australia, regional NSW, regional Tasmania, and regional Queensland led September’s capital good points.

Although progress circumstances stay constructive, it’s turning into more and more clear the housing market moved previous its peak fee of progress in March when nationwide dwelling values elevated by 2.8%.

Since that point, the month-to-month rise in values has eased again to 1.5%.

The slowing momentum will be attributed to larger boundaries for non-homeowners together with fewer authorities incentives to enter the market.

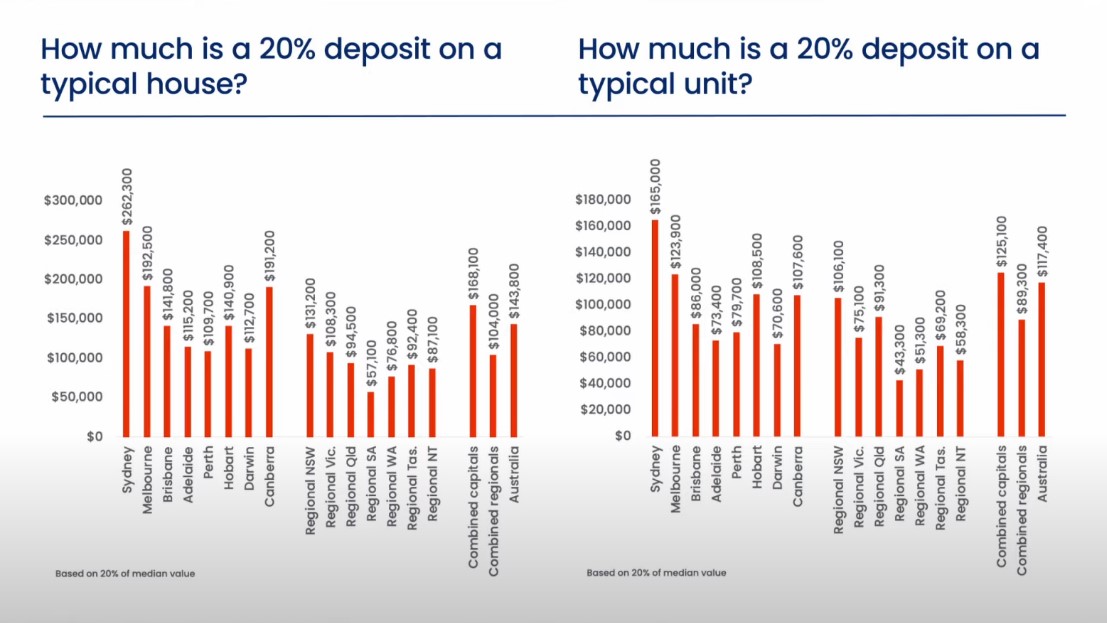

With housing values rising considerably quicker than family incomes, elevating a deposit has change into more difficult for many cohorts of the market, particularly first-home patrons.

Sydney is a major instance the place the median home worth is now simply over $1.3 million.

In order to boost a 20% deposit, the everyday Sydney home purchaser would wish to boost about $262,300.

Existing owners trying to improve, downsize or transfer dwelling could also be much less impacted as they’ve had the good thing about fairness that has accrued as housing values have surged.

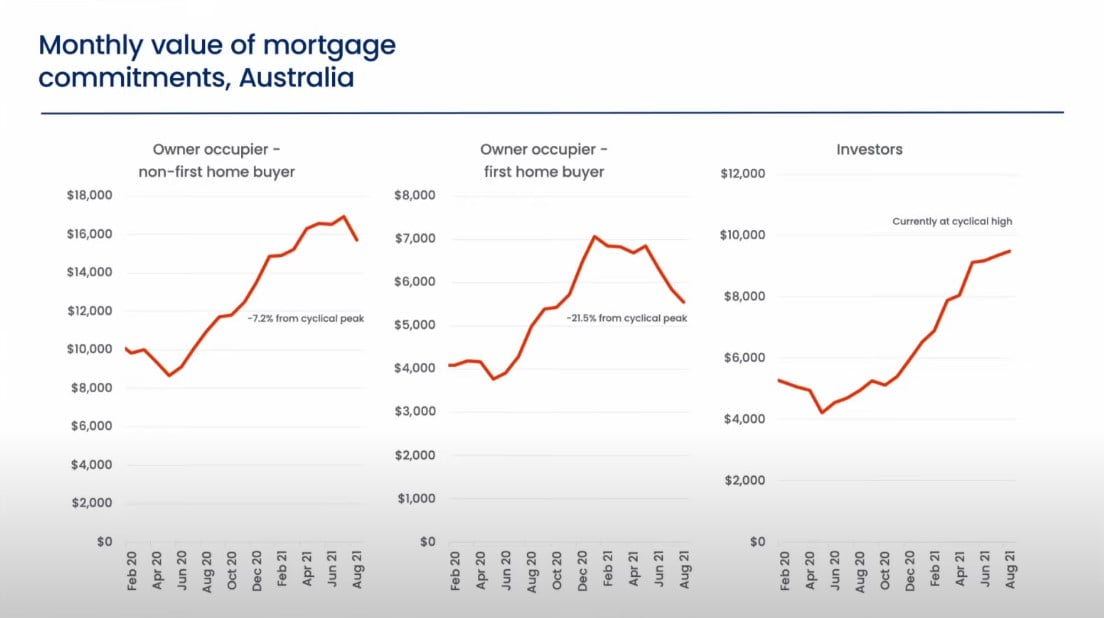

The slowdown in first dwelling purchaser exercise will be seen in lending knowledge, the place the variety of owner-occupier first dwelling purchaser loans has fallen by -23% between January and August.

Over the identical interval, the variety of first dwelling patrons taking out an funding housing mortgage has elevated, albeit from a low base, by 43%, suggesting extra first dwelling patrons are selecting to ‘rentvest’ as a approach of getting their foot within the door.

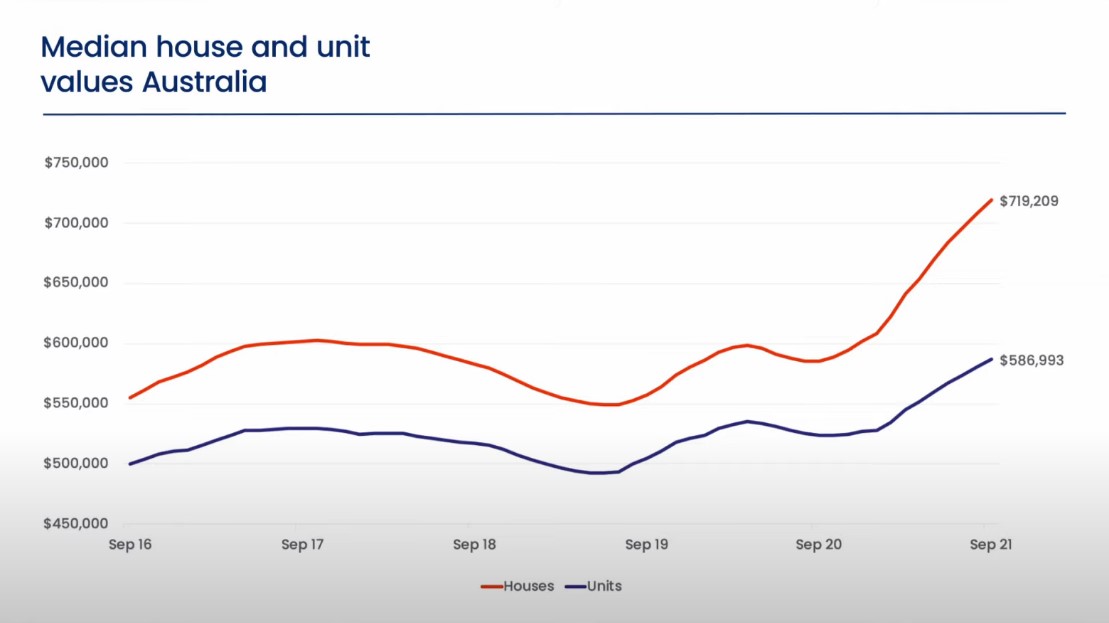

Despite worsening affordability, home values are nonetheless usually rising quicker than unit values; the pattern that has been evident all through many of the COVID interval up to now, particularly throughout the capital cities.

Hobart and Darwin are the one capital cities the place this pattern has not occurred, with unit values rising 5.4 proportion factors and 4.8 proportion factors greater than home values respectively over the previous 12 months.

The causes for this outperformance of the Hobart and Darwin unit markets look to be fairly totally different.

In Hobart, demand is skewed in the direction of a barely older demographic which may be trying to downsize or on the lookout for decrease upkeep housing choices in opposition to a backdrop of scarce unit provide.

In Darwin, the unit sector has moved by way of a long-running over-supply that has pushed costs decrease.

While the median worth of a Darwin unit is the bottom of any capital metropolis, unit rents have surged 20.3% larger over the previous yr, driving gross rental yields to six.9%.

The stronger efficiency of home values relative to unit values is much less apparent outdoors of the capital cities.

The differential between annual home and unit progress charges within the mixed capital cities was 12.3 proportion factors within the 12 months to September, in comparison with a 1.9 proportion level distinction throughout regional Australia.

In reality, the September quarter noticed unit values rising quicker than home values throughout regional Australia.

This might be the reflection of stronger demand for downsizing choices and vacation properties in in style coastal markets.

Persistently low marketed provide stays a key issue putting upwards strain on housing values throughout the nation.

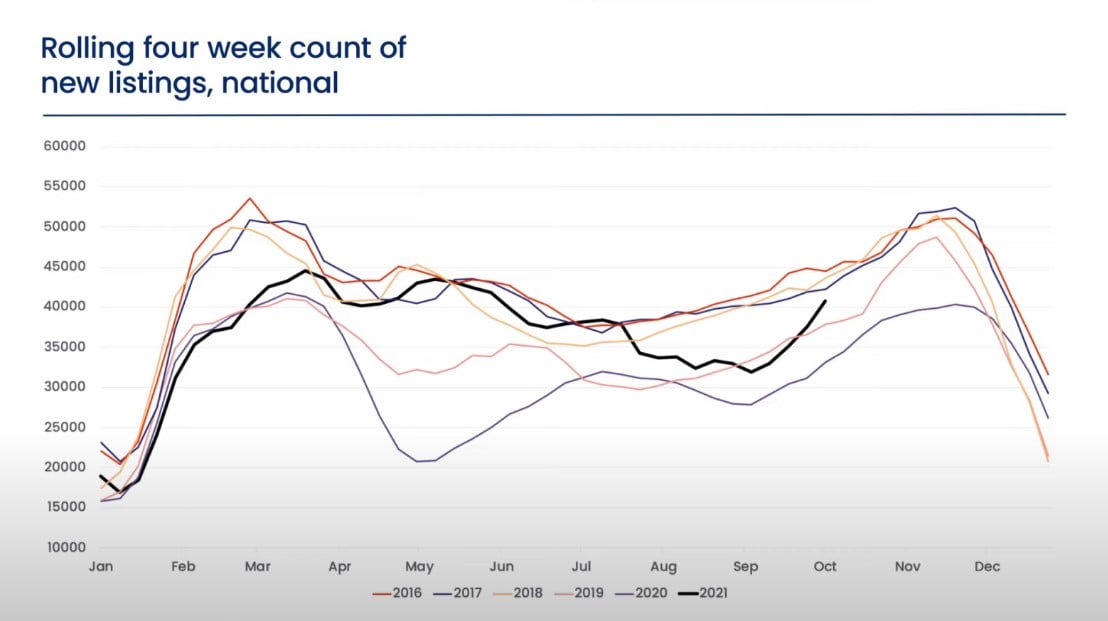

In a constructive signal, the pattern in new listings added to {the marketplace} is now rising, albeit from a low base.

Nationally, primarily based on a rolling four-week depend, the variety of new listings is up 28% because the latest low level in early September, taking the pattern in new listings 3% above the five-year common for this time of the yr.

Although new listings are ramping up, the pattern in complete lively listings stays extraordinarily low, persevering with to replicate the fast fee of absorption seen amidst excessive purchaser demand.

nationally, complete marketed provide ranges are -28.1% beneath the five-year common and each capital metropolis is recording a below-average quantity of marketed provide.

While stock ranges stay low, the variety of dwelling gross sales is properly above common.

CoreLogic estimates the variety of dwelling gross sales throughout Australia was 25.5% larger than the five-year common and 41.9% larger year-on-year on the finish of September.

Such low ranges of accessible provide together with excessive demand are holding promoting circumstances skewed in the direction of distributors.

Nationally, properties are promoting in 35 days, up from 29 days in April, and vendor discounting ranges stay round document lows at -2.8%.

Another issue pointing to sturdy promoting circumstances is the bounce again in public sale clearance charges as restrictions referring to one-on-one property inspections had been eased mid-month throughout Melbourne and Canberra.

By the top of September, the mixed capitals clearance fee had returned to 80.5%, its highest degree since late March.

ALSO READ: Australian housing values rising at the fastest annual pace since June 1989

[ad_2]

Source link