[ad_1]

Please use the menu beneath to navigate to any article part:

Australians are on an enormous dwelling buying spree, borrowing to purchase property at charges not seen earlier than in this nation.

However, our bricks-and-mortar spendathon could also be about to hit a snag as warning bells sound over hovering debt ranges.

Homeownership bonanza

Recent ABS information has confirmed what most of us already knew – that the housing market is operating sizzling, fuelled by low-interest charges and prepared entry to credit score, together with myriad authorities stimulus measures designed to get patrons into the market and spending up huge.

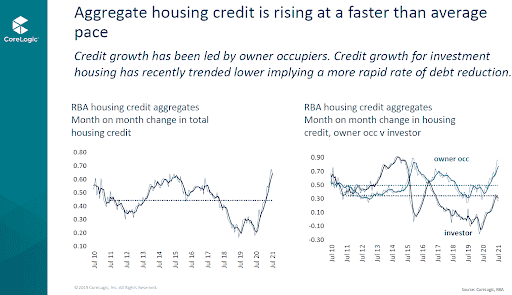

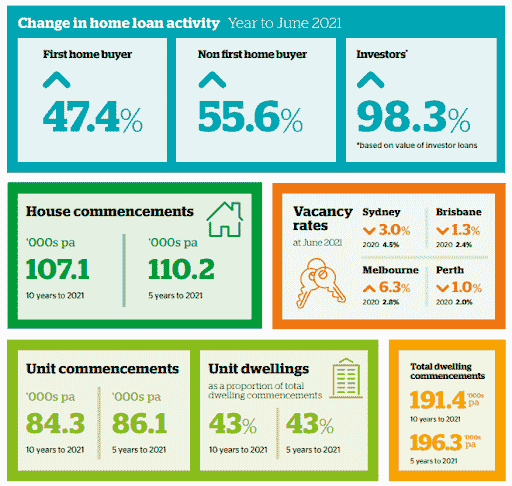

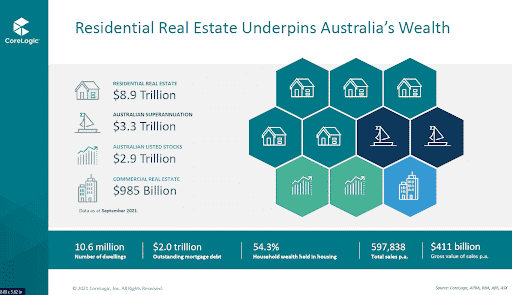

The confluence of those situations has delivered a $38 billion spike in housing loans in the June quarter (of which $31.9 billion of that is owner-occupier dwelling loans and $6 billion in investor loans).

This progress in owner-occupier loans is the strongest in 5 years and exhibits no indicators of slowing.

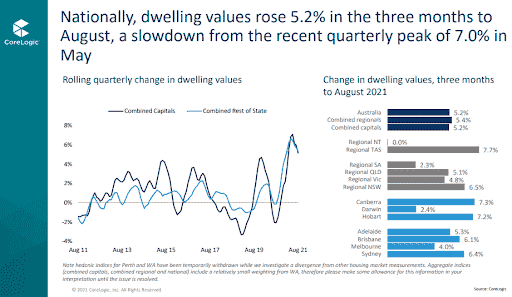

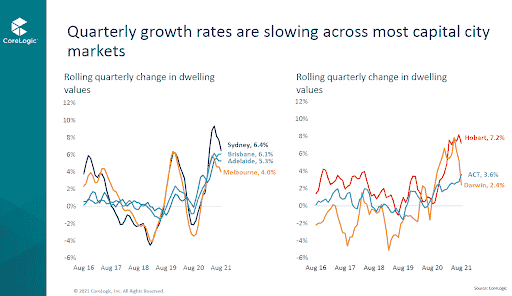

Experts have recommended that home value progress will end the 12 months at round 20 per cent, an exceptional determine that has economists involved.

More folks than ever earlier than are leaping on the homeownership bandwagon and, because the Treasurer identified earlier this week, “(in this housing cycle) a higher proportion of first home buyers and owner-occupiers are entering the market”.

Getting extra FHBs into their very own dwelling has been a serious situation for successive state and federal governments for fairly a while – how you can assist the subsequent technology get a bit of the Australian dream of homeownership.

So, it’s been a trigger for celebration that the present batch of stimulus measures (together with permitting folks to make use of a portion of their superannuation for a home deposit and the federal government guaranteeing loans with lower than 20 per cent deposit so prospects can keep away from the hefty value of lenders mortgage insurance coverage) has been a runaway success.

READ MORE: What’s the difference between borrowing capacity and affordability?

The draw back is debt

However, all this borrowing interprets to sharply rising family debt ranges.

People have entry to very low-cost credit score for the time being and the banks, at all times eager for extra prospects, are lending, so folks are seizing the chance to purchase big-ticket objects – comparable to a home.

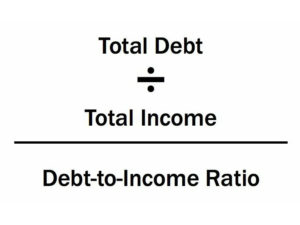

But if family debt ranges get too excessive, particularly debt-to-income ratios, a brand new problem is created. It’s a bit like an enormous sport of whack-a-mole – resolve one drawback over right here after which one other pops up over there.

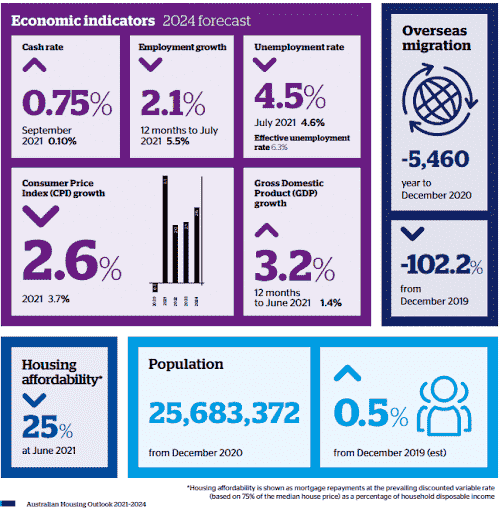

If the economic system was ticking alongside in regular situations, that’s, with no pandemic and a number of lockdowns to stymie progress, we might see jobless numbers falling, and inflation and wages progress to maintain tempo with the spending bonanza.

When companies get numerous prospects, they develop, by placing on extra workers, including extra merchandise and/or providers, and GDP will increase.

However, these are not regular financial situations.

The Treasurer is making an attempt to herd the cats of financial restoration by getting us to spend, (which we are – shopping for homes like they’re going out of vogue) however the different aspect of the dimensions to maintain all of it balanced – employment, wages, and inflation – is just not budging.

Our jobless price is creeping up and economists comparable to Saul Eslake suppose it’s truly a lot increased than is being reported.

Balancing the scales

Well, warning bells sound as a result of the economic system is uncovered to some stress factors that symbolize a big threat.

So vital that the IMF commented on it just lately:

“Structural reforms to spice up housing provide and focused help for low-income households are wanted to enhance housing affordability.

“Macroprudential policy should be tightened and lending standards closely monitored,” a bluntly worded assertion stated.

House costs are rising, placing homeownership out of attain for youthful folks and people on decrease incomes.

And for these stepping into the market, they should borrow ever higher quantities to get their foot on the primary rung of the property ladder.

Debt causes us to cease spending

But excessive family debt can result in a pointy discount in client spending as debtors attempt to funnel additional funds into the mortgage to cut back their debt ranges.

Or it may be that the minimal repayments are sucking up all their disposable revenue, having the instant impact of reducing client spending.

Either approach, financial exercise grinds to a halt.

And proper now, the Treasurer is hoping a client spendathon is the ticket out of this pandemic-induced hunch.

A contraction in client spending couldn’t come at a worse time as he desperately fights to keep away from two consecutive quarters of contraction – in different phrases, a recession.

Lending situations

The further threat sits with the banks as they maintain a big quantity of loans the place the debt-to-income ratio might be a lot increased than beneficial ranges.

Banks typically lend on the debt-to-income ratio of round 6; that’s, they may lend an quantity six instances the quantity of the family annual revenue.

In the present local weather (learn: pandemic), banks have been inspired to lend and there’s a concern that there are loans on the books the place the DTI is increased than 6, probably as much as 7 or 8.

This is doubtlessly not too regarding whereas charges are low, nonetheless, if we see a price rise in the subsequent few years (possible in early 2024, if RBA alerts are to be believed) then this might push many shoppers into default.

To be clear, at this stage, the danger of this appears low.

The financial watchdogs are significantly delicate to this case following the 2007 world monetary disaster that was triggered by a collapse of the US housing market beneath the load of a mountain of “low-doc” loans.

It appears unlikely that we’re going through the same scenario right here.

APRA chair Wayne Byres advised the House of Economics standing committee earlier this month that there was no signal of requirements deteriorating and balance sheets were still strong.

But, the RBA and APRA are watching like hawks.

Meeting with the cash males

Simply put, they met to debate our runaway housing market and what APRA and the RBA might probably do to rein in the bolting horse.

The Treasurer revealed that he was speaking about “carefully targeted and timely adjustments” for our financial coverage.

A change is definitely coming.

So, what may be executed?

Well, there are a number of levers that the Treasurer might pull to decrease the present publicity.

- Rate rise

The RBA might raise the minimal price that banks use for dwelling loans.

This would make credit score costlier and gradual borrower exercise.

Governor Lowe has been very clear for greater than 12 months – the RBA wouldn’t think about lifting charges till inflation and wages progress confirmed some indicators of life and this has not occurred but.

He has reiterated, virtually month-to-month, that 2024 was the earliest the RBA would think about lifting charges.

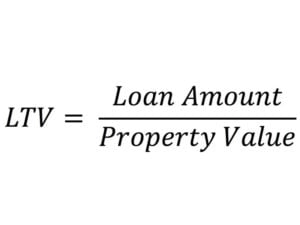

2. LVR restrictions

The loan-to-value ratio is a measure of how a lot cash the financial institution lends in opposition to the worth of the property.

Anything above 80 per cent is taken into account a excessive LVR and is a riskier proposition (as a result of the borrower has not established a very good report of financial savings or demonstrated compellingly a capability to repay).

In the June quarter, greater than 20 per cent of loans written have been high-LVR loans.

These are normally the primary loans to default.

Regulators are now contemplating imposing limits on what number of high-LVR loans banks have on their books as a method to restrict threat to the stability sheet.

This means it might turn out to be tougher to borrow, significantly with smaller deposits.

Banks will quickly insist upon at the very least a 20 per cent deposit.

These measures have been just lately launched in New Zealand by their Reserve Bank and this has had fairly a direct impact to cut back borrowings over the ditch.

3. Greater scrutiny

The high quality of lending is beneath the microscope, with APRA and the RBA coaching their laser-like consideration on lending high quality and family capability to repay.

This could have the impact of inflicting banks to pay nearer consideration to spending habits and financial savings habits and decision-making could turn out to be extra conservative.

For anybody contemplating a home buy in the close to future, you could discover the banks search higher ranges of documentation to help your spending claims.

4. DTI limits

The commonplace debt-to-income ratio is 6 (ie lending 6 instances the revenue stage, so, extrapolating on the sooner instance, a family revenue of $200,000 a 12 months would qualify to borrow $1.2 million).

If DTI limits are launched, this could have a direct influence on home gross sales in the capital cities, significantly Sydney and Melbourne.

House costs in these cities are already so excessive that solely a only a few high-income earners would be capable of borrow on a DTI of 6 instances.

Anyone on a median wage (round $85,000 – $100,000) can be locked out.

With the present housing progress unsustainable primarily based on lack of wage progress, this measure is, in a approach, already being applied however sadly it impacts these on low wages greater than our higher-income earners, and therein lies the disparity that Government is anxious about.

Action is required

There is little question that motion is required.

Left unfettered, the housing market will proceed its astronomical journey to the celebs and Australia will rapidly transfer from the second-highest mortgage debt ranges in the world to the best (we at present path behind the Swiss).

Supply: if Governments should make it simpler for provide to be created, this may assist tackle demand and be an efficient device to help in managing home value progress.

But, the necessity is urgent, and fixing the availability situation is a long-term answer, so for now it’s possible that we’ll see a mixture of all of the instruments getting used.

My finest guess is that we’ll see banks tighten their lending standards, trying extra carefully at spending and disposable revenue.

DTI and LVR ranges might be beneath the microscope and loans might be smaller, extra in line with the capability to repay, making an allowance for future price rises.

For anybody contemplating a house mortgage, it’s necessary to weigh all of your choices and put together for this new lending atmosphere to provide your self the most effective probability of success.

READ MORE: Macroprudential measures creep closer

[ad_2]

Source link