What can you claim when renovating?

[ad_1] More and more Australian investors are choosing to renovate their investment properties before leasing them out. However, investors who live in the property while

[ad_1] More and more Australian investors are choosing to renovate their investment properties before leasing them out. However, investors who live in the property while

[ad_1] One of the most common mistakes made by property investors when completing their annual tax return is confusing repairs, maintenance and improvements. It’s important

[ad_1] Investors who self-assess or estimate costs based on their own judgement when lodging their tax return are potentially missing out on thousands of dollars,

[ad_1] Maximise the depreciation benefits of an investment property While many property investors consider location, purchase price and vacancy rates when contemplating an investment property,

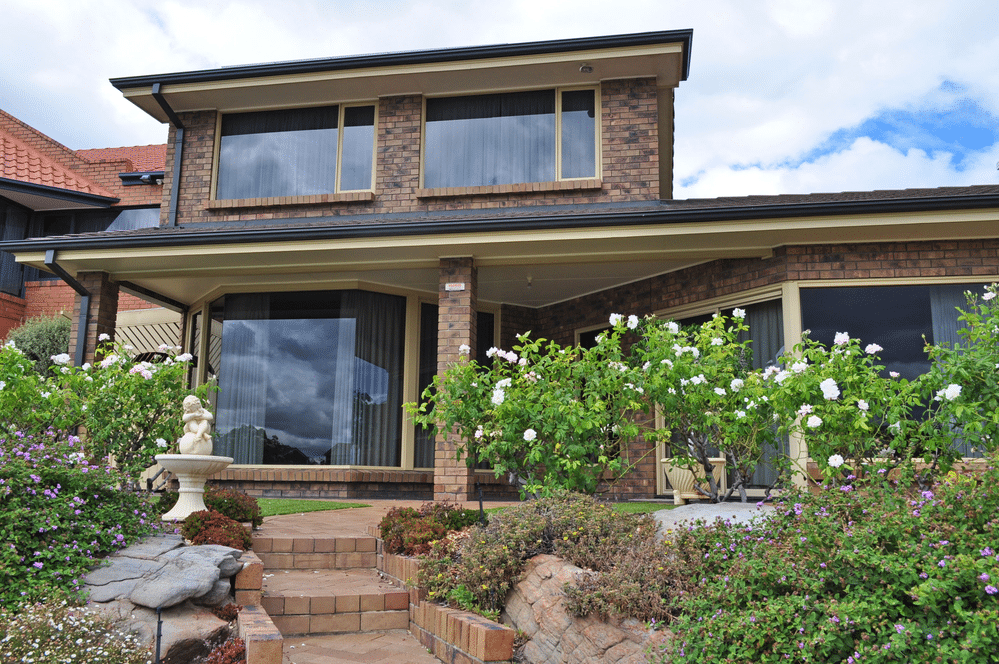

[ad_1] It’s not unusual for a homeowner to turn their main residence into an investment property. They may do this for various reasons, such as

[ad_1] It’s not unusual for a homeowner to turn their main residence into an investment property. They may do this for various reasons, such as

[ad_1] Maximise the depreciation benefits of an investment property While many property investors consider location, purchase price and vacancy rates when contemplating an investment property,

[ad_1] It’s not unusual for a homeowner to turn their main residence into an investment property. They may do this for various reasons, such as

[ad_1] More and extra Australian buyers are selecting to renovate their funding properties earlier than leasing them out. However, buyers who stay within the property

[ad_1] One of the commonest errors made by property buyers when finishing their annual tax return is complicated repairs, maintenance and improvements. It’s necessary to