[ad_1]

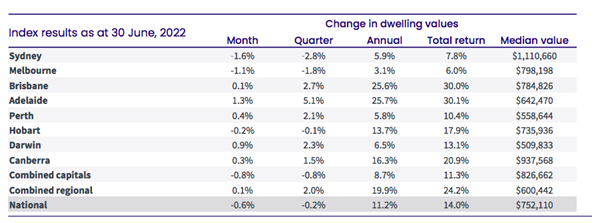

Price growth across the country has continued to slow down last month with the latest CoreLogic Home Value Index (HVI) showing that values dipped -0.6% in June.

The largest falls were in Sydney and Melbourne, where values were down -1.6% and -1.1% respectively while housing values were also lower by -0.2% in Hobart.

According to CoreLogic, every capital city and broad rest of state region is now well past their peak growth rate.

Growth in Brisbane eased to 0.1% in June, while Adelaide continues to be the strongest market in the country with values increasing by 1.3%. Growth in Perth’s housing values, which were temporarily showing a second wind as state borders reopened, are again losing steam with values up just 0.4% in June.

Regional markets have also seen a sharp reduction in growth with values only 0.1% higher last month.

Source: CoreLogic

CoreLogic Research Director, Tim Lawless, said the housing market’s sharper reduction in growth coincides with the May cash rate hike, surging inflation and low consumer sentiment.

“Housing value growth has been easing since moving through a peak in March last year, when early drivers of the slowdown included rising fixed term mortgage rates, an expiry of fiscal support, a trend towards lower consumer sentiment, affordability challenges and tighter credit conditions,” Mr Lawless said.

“More recently, surging inflation and a rapidly rising cash rate have added further momentum to the downwards trend. Since the initial cash rate hike on May 5, most housing markets around the country have seen a sharper reduction in the rate of growth.

“Considering inflation is likely to remain stubbornly high for some time, and interest rates are expected to rise substantially in response, it’s likely the rate of decline in housing values will continue to gather steam and become more widespread.”

Unit markets are holding their value a little better than houses across the largest capitals.

“The stronger performance across the unit sector comes after house values consistently outperformed units through the upswing,” Mr Lawless said.

“Since the onset of the pandemic in March 2020, capital city unit values have risen 9.8% compared to 24.7% for houses, resulting in better affordability across the medium to high density sector.”

Listings on the rise

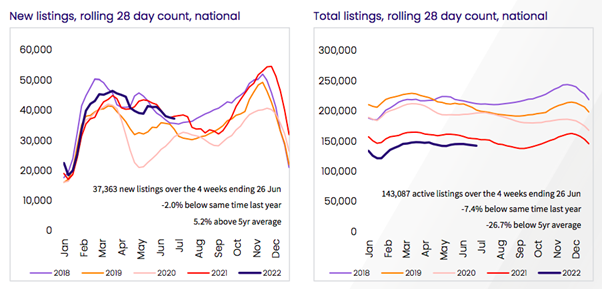

With price growth starting to ease, listings have been one of the driving forces behind the slowdown.

While, national advertised stock levels remain -7.4% lower than 2021, in Sydney and Melbourne, where housing conditions are the weakest, total advertised supply is now 7-8% above the levels recorded a year ago and well above the five-year average.

Hobart has seen advertised stock levels jump 48.4% higher relative to last year and inventory is 20.7% higher in Canberra. While Adelaide, Brisbane and Perth, still have listing levels lower than the same time last year.

Mr Lawless said the rise in advertised supply across some markets is mostly due to a slowdown in the rate of absorption.

“Estimated transactions in Sydney throughout the June quarter were -36.7% lower than a year ago while Melbourne is down -18.3%,” he said.

“At the same time, the flow of new listings added to the market is falling as selling conditions becoming more challenging and listings move into a seasonal lull.

“We aren’t seeing any signs of panicked selling as housing conditions cool, in fact the trend is the opposite, with the flow of new listings to the market slowing.”

Source: CoreLogic

Rents still rising

Rents are still increasing at 0.9% per month equating to an annual increase of 9.5%. This is the highest annual growth rate since December 2007 when record levels of overseas migration pushed rental demand higher.

“A reduction in average household size through the pandemic helps to explain such high rental demand during a time of closed international borders,” Mr Lawless said.

“Additionally, overall rental supply has probably been negatively impacted by the long running downturn in investment activity between 2015 and 2021.”

Outlook skewed to the downside

Australia’s housing market outlook is becoming increasingly skewed to the downside, with the trajectory of housing values heavily dependent on the path interest rates take.

Mr Lawless said high inflation will continue to put pressure on the RBA to hike rates, which will ultimately continue to weigh on property values.

“Although sales activity remained above average throughout the June quarter, it’s likely the number of home sales will continue to drift lower as housing demand cools and lenders become more cautious in their approach towards borrowers,” he said.

Mr Lawless said how far housing values fall through the downturn remains highly uncertain, however a peak to trough decline of more than 10% is becoming more mainstream across the various private sector forecasts.

Strong labour markets will be one key factor in supporting mortgage repayments and keeping distressed listings off the market as well as borrower repayment buffers.

[ad_2]

Source link