[ad_1]

Please use the menu below to navigate to any article section:

Since the coronavirus pandemic hit our shores, Australia’s property market has grown at an unprecedented rate.

As lockdowns continued and the work-from-home trend became more permanent, many people flocked to suburban and regional areas in search of a better and bigger lifestyle.

But now the resurgence of Australia’s migration has pulled focus back to our cities, springing markets close to our CBDs back into life.

And data analysis by Domain has revealed the top 5 best value suburbs within 5km of the CBD, in Sydney, Melbourne, Brisbane, Adelaide and Perth.

Here’s the full list of each major city.

Sydney

Sydney’s property market is the most expensive across the country, with a median house price of $1.6 million and more than a quarter of the city’s suburbs recording median prices in excess of $2 million.

Within a 5km ring of the city, Bellevue Hill has a median of a huge $7.27 million, and there are multiple suburbs where the median house price is upwards of $3 million or $4 million, such as Woollahra, Paddington, Cremorne, Greenwich and Birchgrove.

But not every one of Sydney’s inner suburbs is so out of reach.

There are some Sydney suburbs, most of which are in the inner west, which have a more affordable price tag, Domain’s data reveals.

Erskineville, which is just 4km west of the city, has a median house price of $1.69 million.

The nearby suburbs of Newtown, Alexandria and Camperdown all also have median prices of $1.75 million, $1.9 million and $1.91 million respectively, which are the lowest in the 5km city ring.

Redfern is the closest to the city, located within 3km of Sydney’s centre, with a house price median of $1.86 million.

Melbourne

Melbourne house and unit price growth gained momentum over the December quarter as buyer and seller activity rebounded post lockdown.

Melbourne’s house prices reached a new record high at $1.1 million, which is the strongest annual gain since 2010, at 18.6% – this represents a $660 per day increase over the quarter.

Median property prices don’t come close to those in Sydney, but after a dip in the market in 2020 amid the extended state-wide Victorian Covid-19 lockdown, property prices have skyrocketed.

Within 5km of the city is Toorak, Melbourne’s most exclusive and affluent suburb, which has a median house price currently sitting at a whopping $5.38 million.

But there are a number of other nearby suburbs which are much more affordable.

The best value suburb within 5km of Melbourne’s CBD in North Melbourne.

At just 3.7km from the city, you can find properties here around the $1.2 million mark.

Next on the list is Collingwood which is 2.9km from the CBD, with a $1.225 million median.

Abbotsford, Richmond and Fitzroy take up the remaining spots on the top 5 list with median prices of $1.28 million, $1.41 million and $1.42 million respectively.

Brisbane

Brisbane’s house prices have seen the steepest annual climb in 13 years as the city’s property market comes to grips with relentless Covid-19-induced demand for property.

In 2021 the city experienced a once-in-a-generation property boom that resulted in almost 400 suburbs joining the million-dollar club.

Brisbane’s most expensive suburb, Teneriffe, sits within a close 3.5km distance of the city centre.

But with a $2.47 million median property price, these houses and apartments are out of range for many.

Even units in Teneriffe are more expensive than the rest of Brisbane with a median of $683,000.

But there are 5 suburbs equally close to the CBD where prices are less than half the price, and some are even under $1 million.

Annerley is the city’s most affordable suburb sitting 4.8km from the CBD and with a median house price of $945,000.

And there is another inner-city suburb that also has a sub-million dollar price tag.

The city-fringe suburb Spring Hill, just 1km north of the city has a $927,500 median house price.

Elsewhere in Brisbane West, Greenslopes, Kelvin Grove and Wooloongabba make up the remainder of the top 5 list with $1 million, $1.025 million and $1.13 million median property prices.

Adelaide

House prices recorded the steepest gains ever with an increase of 8.6% quarterly and 27.5% annually, setting a new record high of $731,547.

Demand for Adelaide property remains strong as the number of homes sold reaches its highest point on record with its tight supply-demand ratio still heavily favouring sellers.

Within a 5km radius of the CBD, the best value suburb is Richmond with a $575,000 median property price.

Kurralta Park comes to a close second place with $593,000, followed by Brompton, Brooklyn Park and Prospect which have $593,700, $680,000 and $721,500 median property prices respectively.

Perth

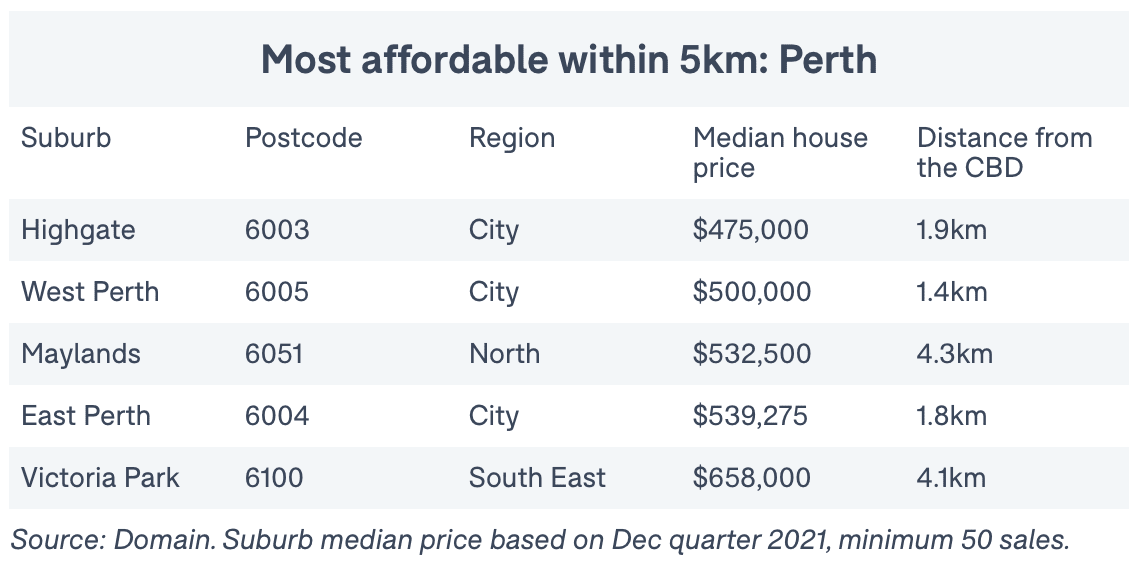

Despite the increase in house and unit prices, the pace of growth has slowed compared to that seen in late 2020 and early 2021 and Perth continues to hold the title of the most affordable city to buy a house as prices swiftly rise across the other cities.

Most of the best value suburbs within a five-kilometre radius of the CBD are cheaper than Perth’s overall median of $612,348.

Highgate, just 1.9km from the city, has the lowest median house price of $475,000.

West Perth and East Perth also fall below Greater Perth’s median and are less than 2km from the CBD.

Maylands is 4.3km north of the city with a $532,500 median property price and Victoria Park is 4.1km southeast with a $658,000 median.

Planning to invest? Remember this

Because despite these areas being ‘cheap’, their low median house prices alone aren’t enough alone to warrant a good investment opportunity.

‘Cheap’ property will always be ‘cheap’ so don’t get lured into thinking you’re getting a bargain.

Also, don’t expect investment-grade returns from secondary locations and properties.

Location, location, location

And not all locations are created equal.

Some suburbs will be more popular than others, some areas will have more scarcity than others and over time some land will increase in value more than others.

That’s why it’s important to buy your investment property in a suburb that is dominated by more homeowners, rather than a suburb where tenants predominate.

And you’ll find suburbs where more affluent owners live will outperform the cheaper outer suburbs where wages growth is likely to stagnate moving forward.

Overall, by focussing your research on what those often overlooked owner-occupiers are doing, you may just find an investment that outperforms the market and delivers strong value and growth over the long term.

[ad_2]

Source link