[ad_1]

Australia recorded its first case of COVID-19 on 25 January 2020 with most of the states and territories introducing border and movement restrictions by mid-to-late March 2020.

Two years on, COVID has seen a marked impact on the Australian property market.

Housing preferences have shifted towards lower density and regional options, translating to stronger value growth across these sectors of the market.

House values are up 28.1% compared with a 13.7% rise in unit values while regional housing values (37.2% for houses and 32.6% for units) have risen higher than their capital city counterparts (25.2% for houses and 10.6% for units).

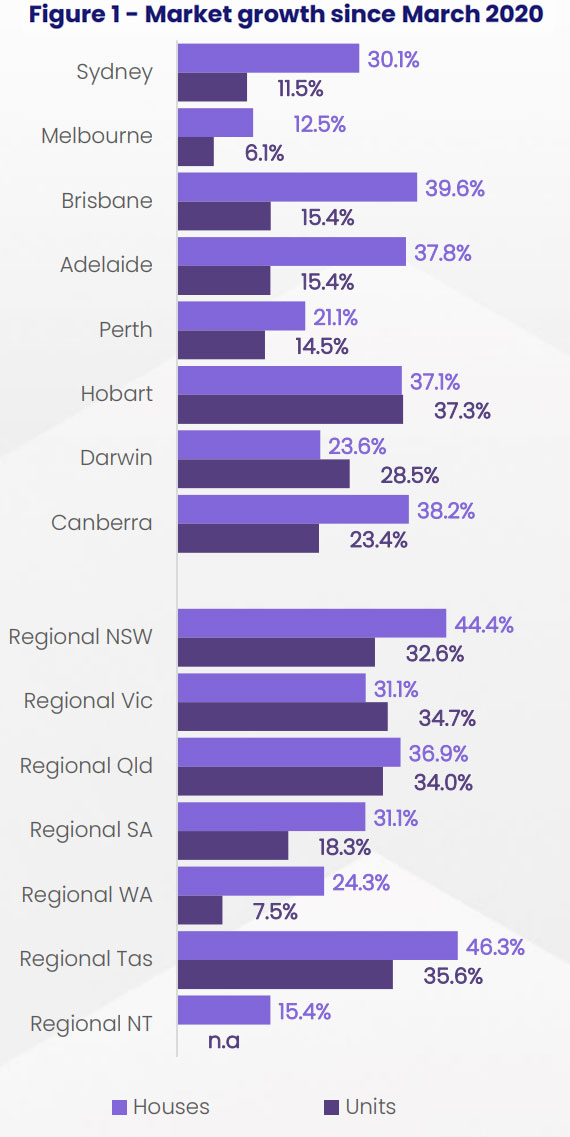

Figure 1 shows the change in values seen since March 2020.

All but two markets recorded double-digit value growth, namely the Melbourne (6.1%) and Regional WA (7.5%) unit markets, while Hobart and Darwin were the only markets to record stronger unit appreciation (37.3% and 28.5% respectively) compared to their house markets (37.1% and 23.6% respectively).

While some markets are still recording growth figures well above average, most markets are now showing signs of easing growth conditions.

With monthly growth rates trending downwards over the past 11 months, annual appreciation has now started to reduce after recording a cyclical peak in January.

Growth in unit values over the preceding 12 months fell from 14.3% in January to 13.2% in February, while annual growth in house values fell from 24.8% to 22.9% over the same period.

This sharper slowdown in the pace of growth in house values saw the annual performance gap between houses and units fall below 10 percentage points for the first time in six months, to 9.6%.

With many of the headwinds that had previously helped prop up the property market starting to lose steam, including low advertised supply and low-interest rates, it’s likely the performance gap will continue to compress as growth trends ease further, investment activity rises and affordability constraints deflect more demand towards the medium to high-density sector.

Growth in national unit values remained steady over the month, rising 0.3%, while growth in house values slowed from 1.3% in January to 0.7% in February.

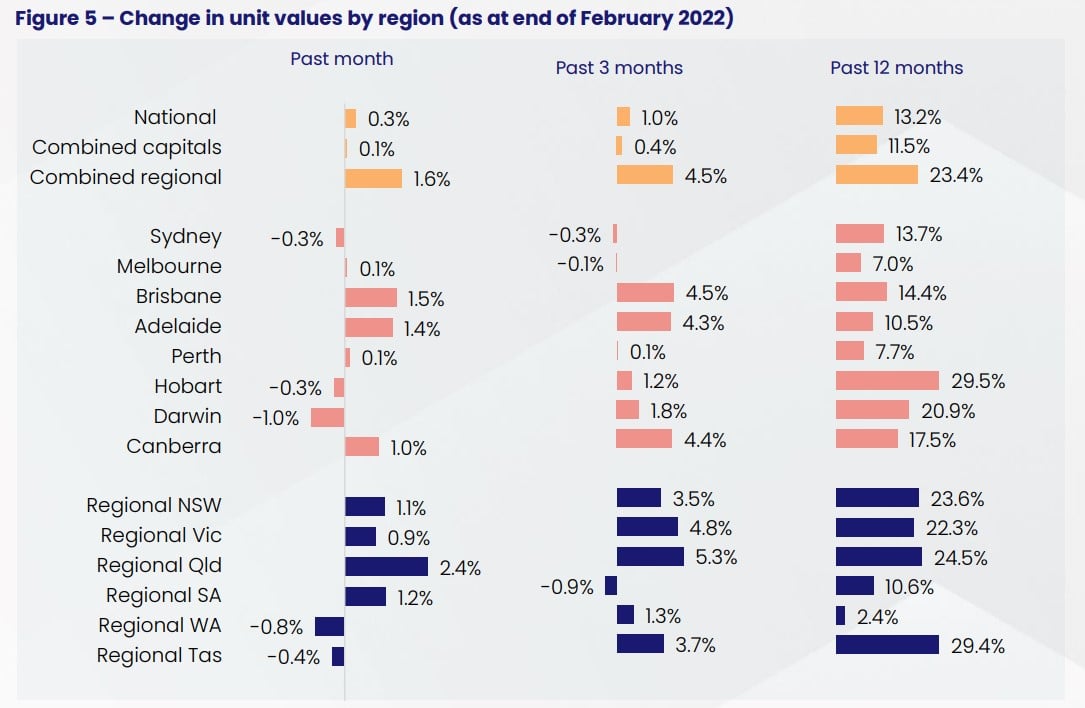

Conditions are becoming more diverse amongst the individual markets with only Queensland’s unit market yet to show any real signs of easing growth conditions.

Over February, regional QLD unit values recorded the highest monthly value rise (2.4%) since March 2003, largely driven by strong unit growth in the regional areas of SEQ including Sunshine Coast (2.7%) and Gold Coast (2.3%), as well as Wide Bay (3.7%) and Cairns (2.6%).

Regional SA recorded a 1.2% rise in values over February following a -1.2% fall in January and a -0.9% fall in December.

Unit values in regional NSW rose 3.5% over the three months to February, down from a cyclical peak of 7.0% in July.

At the other end of the spectrum, unit values depreciated over the month in regional WA (-0.8%) and regional Tasmania (-0.4%) equivalent to a median price decrease of $2,177 and $1,380 respectively.

Brisbane led the pace of growth in unit values across the capital cities, recording a 1.5% appreciation in February.

This is up slightly from the 1.4% growth in January but down from the cyclical peak monthly growth rate recorded in December (1.6%), resulting in a new cyclical peak in both quarterly (4.5%) and annual (14.4%) unit growth rates.

Adelaide units recorded a decline in the quarterly growth rate (4.3%) compared to the three months to January (4.4%) while Canberra units recorded their lowest monthly growth rate (1.0%) since June 2021.

Despite this slowdown, both markets recorded a new cyclical high in their annual growth rates (10.5% and 17.5% respectively).

At the other end of the scale, Darwin (-1.0%), Sydney (-0.3%), and Hobart (-0.3%) recorded a fall in monthly unit values while both Melbourne and Perth units recorded a monthly appreciation of 0.1% over February.

Total advertised listing levels continue to help explain the diverging growth trends amongst unit markets.

This is an increase from the four weeks ending 30th January, when listing levels were down -11.5% and -20.4% respectively, suggesting that newly listed unit supply is not being absorbed by the market increasing total listing counts.

Total advertised unit listings remain well below the 5-year average in Brisbane (-39.1%) and Adelaide (-45.6%) and -44.2% below average across the combined regional unit market.

Sydney (7.0%), Melbourne (16.1%), and Perth’s (3.7%) total unit listings counts were above the previous 5-year average at the end of February, helping to explain the poor unit growth seen over the 3 months to February ( -0.3%, -0.1%, and 0.1% respectively).

Continuing the trend established last month, national unit rents increased more than house rents over February, up 0.9% compared to 0.7%.

The gap between annual rental growth in houses and units has compressed from 8.1 percentage points in May 2021 to 1.3 percentage points in February with national house rents recording a 9.1% rise over the 12 months to February compared to a 7.8% rise in units over the same period.

Units in Regional SA led the pace of rental growth rising 2.8% over February, equivalent to a $7 weekly rental rise, followed by Melbourne (1.2%) and Hobart (1.2%).

On the other end of the scale, Darwin unit rents fell -0.3% over the month, followed by Regional Victorian units, which rose by 0.5%, and regional WA units (0.6%).

Figure 6 shows the annual rental growth rate of capital city units.

With national unit rents now rising faster than unit capital gains, gross rental yields on units nationally are now trending upwards, growing 5 basis points since it bottomed out in December (3.66%).

Retuning yields of 3.71%, national unit yields are now 66 basis points above national house yields (3.05%) which continue to compress month on month, albeit at 1 basis point a month.

Figure 7 shows current gross rental yields on units compared to those recorded this time last year.

Continuing the results recorded last month, all markets, except for regional WA and regional SA are recording yields below those recorded this time last year, although Perth’s current yields (5.43%) are now within 5 basis points of those recorded last year (4.48%).

With sustained value appreciation eroding housing affordability and high inflation making an interest rate rise this year a near certainty, and housing supply levels beginning to normalise, the Australian property market and by extension the Australian unit market face some headwinds.

CoreLogic’s Tim Lawless says,

“While the downside risks to housing are growing, there are some upsides that should help to insulate the market from a sudden downturn.”

The opening of domestic and international borders should help bolster unit demand in inner-city precincts popular with foreign students and visitors, which will, in time, help bolster investor demand.

Mr. Lawless added,

“Improving economic conditions and higher wages growth should also help to keep a floor under housing demand and distressed property sales to a minimum.”

ALSO READ: These 6 major trends will reshape Australia’s property market in 2022

[ad_2]

Source link